Gold’s new heavy hitter

In 2020, Brightstar Resources (ASX: BTR) debuted in the WA gold game.

Previously known as Stone Resources Australia, the company was rebirthed in 2020 with not only a new name and new management, but a clear plan towards gold production.

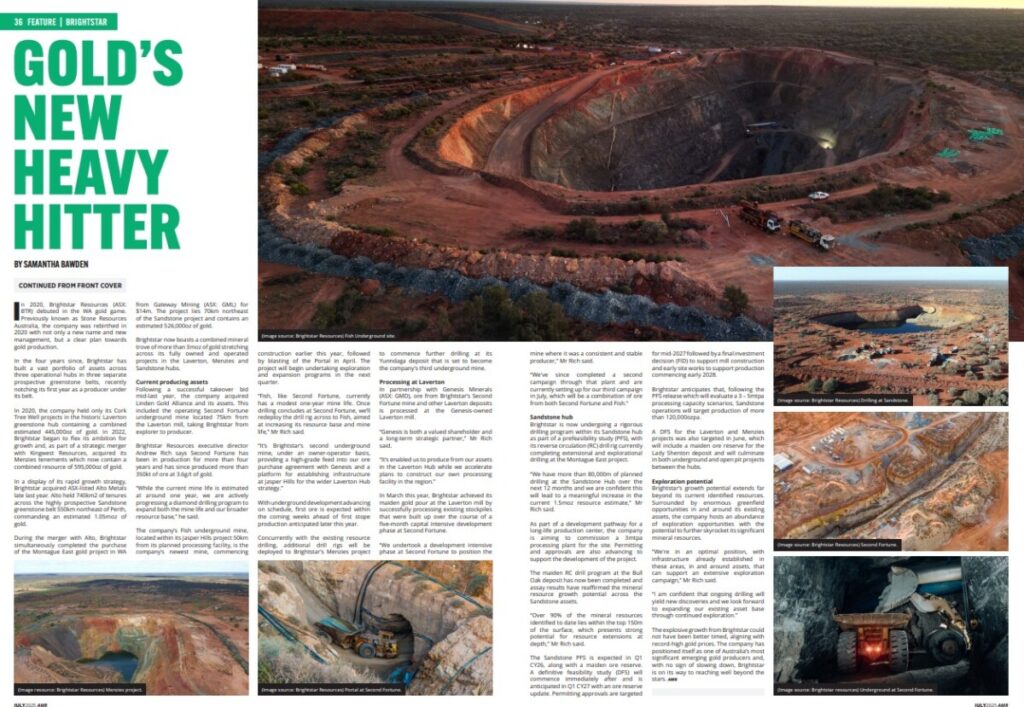

In the four years since, Brightstar has built a vast portfolio of assets across three operational hubs in three separate prospective greenstone belts, recently notching its first year as a producer under its belt.

In 2020, the company held only its Cork Tree Well projects in the historic Laverton greenstone hub containing a combined estimated 445,000oz of gold. In 2022, Brightstar began to flex its ambition for growth and, as part of a strategic merger with Kingwest Resources, acquired its Menzies tenements which now contain a combined resource of 595,000oz of gold.

In a display of its rapid growth strategy, Brightstar acquired ASX-listed Alto Metals late last year. Alto held 740km2 of tenures across the highly prospective Sandstone greenstone belt 550km northeast of Perth, commanding an estimated 1.05moz of gold.

During the merger with Alto, Brightstar simultaneously completed the purchase of the Montague East gold project in WA from Gateway Mining (ASX: GML) for $14m. The project lies 70km northeast of the Sandstone project and contains an estimated 526,000oz of gold.

Brightstar now boasts a combined mineral trove of more than 3moz of gold stretching across its fully owned and operated projects in the Laverton, Menzies and Sandstone hubs.

Current producing assets

Following a successful takeover bid mid-last year, the company acquired Linden Gold Alliance and its assets. This included the operating Second Fortune underground mine located 75km from the Laverton mill, taking Brightstar from explorer to producer.

Brightstar Resources executive director Andrew Rich says Second Fortune has been in production for more than four years and has since produced more than 350kt of ore at 3.6g/t of gold.

“While the current mine life is estimated at around one year, we are actively progressing a diamond drilling program to expand both the mine life and our broader resource base,” he said.

The company’s Fish underground mine, located within its Jasper Hills project 50km from its planned processing facility, is the company’s newest mine, commencing construction earlier this year, followed by blasting of the Portal in April. The project will begin undertaking exploration and expansion programs in the next quarter.

“Fish, like Second Fortune, currently has a modest one-year mine life. Once drilling concludes at Second Fortune, we’ll redeploy the drill rig across to Fish, aimed at increasing its resource base and mine life,” Mr Rich said.

“It’s Brightstar’s second underground mine, under an owner-operator basis, providing a high-grade feed into our ore purchase agreement with Genesis and a platform for establishing infrastructure at Jasper Hills for the wider Laverton Hub strategy.”

With underground development advancing on schedule, first ore is expected within the coming weeks ahead of first stope production anticipated later this year.

Concurrently with the existing resource drilling, additional drill rigs will be deployed to Brightstar’s Menzies project to commence further drilling at its Yunndaga deposit that is set to become the company’s third underground mine.

Processing at Laverton

In partnership with Genesis Minerals (ASX: GMD), ore from Brightstar’s Second Fortune mine and other Laverton deposits is processed at the Genesis-owned Laverton mill.

“Genesis is both a valued shareholder and a long-term strategic partner,” Mr Rich said.

“It’s enabled us to produce from our assets in the Laverton Hub while we accelerate plans to construct our own processing facility in the region.”

In March this year, Brightstar achieved its maiden gold pour at the Laverton mill by successfully processing existing stockpiles that were built up over the course of a five-month capital intensive development phase at Second Fortune.

“We undertook a development intensive phase at Second Fortune to position the mine where it was a consistent and stable producer,” Mr Rich said.

“We’ve since completed a second campaign through that plant and are currently setting up for our third campaign in July, which will be a combination of ore from both Second Fortune and Fish.”

Sandstone hub

Brightstar is now undergoing a rigorous drilling program within its Sandstone hub as part of a prefeasibility study (PFS), with its reverse circulation (RC) drill rig currently completing extensional and explorational drilling at the Montague East project.

“We have more than 80,000m of planned drilling at the Sandstone Hub over the next 12 months and we are confident this will lead to a meaningful increase in the current 1.5moz resource estimate,” Mr Rich said.

As part of a development pathway for a long-life production center, the company is aiming to commission a 3mtpa processing plant for the site. Permitting and approvals are also advancing to support the development of the project.

The maiden RC drill program at the Bull Oak deposit has now been completed and assay results have reaffirmed the mineral resource growth potential across the Sandstone assets.

“Over 90% of the mineral resources identified to date lies within the top 150m of the surface, which presents strong potential for resource extensions at depth,” Mr Rich said.

The Sandstone PFS is expected in Q1 CY26, along with a maiden ore reserve. A definitive feasibility study (DFS) will commence immediately after and is anticipated in Q1 CY27 with an ore reserve update. Permitting approvals are targeted for mid-2027 followed by a final investment decision (FID) to support mill construction and early site works to support production commencing early 2028.

Brightstar anticipates that, following the PFS release which will evaluate a 3 – 5mtpa processing capacity scenarios, Sandstone operations will target production of more than 120,000ozpa.

A DFS for the Laverton and Menzies projects was also targeted in June, which will include a maiden ore reserve for the Lady Shenton deposit and will culminate in both underground and open pit projects between the hubs.

Exploration potential

Brightstar’s growth potential extends far beyond its current identified resources. Surrounded by enormous greenfield opportunities in and around its existing assets, the company hosts an abundance of exploration opportunities with the potential to further skyrocket its significant mineral resources.

“We’re in an optimal position, with infrastructure already established in these areas, in and around assets, that can support an extensive exploration campaign,” Mr Rich said.

“I am confident that ongoing drilling will yield new discoveries and we look forward to expanding our existing asset base through continued exploration.”

The explosive growth from Brightstar could not have been better timed, aligning with record-high gold prices. The company has positioned itself as one of Australia’s most significant emerging gold producers and, with no sign of slowing down, Brightstar is on its way to reaching well beyond the stars.