New Hope delivers strong half-year results amid expansion and cost efficiency

New Hope Group (ASX: NHC) has delivered a strong performance in H1 2025, increasing coal production, cutting costs and boosting returns to shareholders.

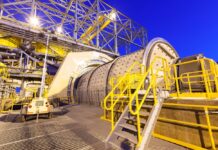

The company produced 5.4mt of saleable coal, a 33% increase, while coal sales rose by 44%. Bengalla Mine reached steady-state production, delivering 4.2mt, while New Acland ramped up to 1.2mt, accounting to nearly four times the mine’s previous output.

Improved efficiencies also reduced Bengalla’s production costs by 16% to $68.3 per tonne, with further cost savings expected at the New Acland operation as production increases.

New Hope chief executive Rob Bishop says the company’s earnings have improved considerably, with future production at New Acland being a key focus as the year progresses.

“We have had a strong first half, with our Bengalla Mine now operating at 13.4mtpa capacity and New Acland Mine now having a clear runway to achieving ~5mtpa run rate by 2027,” he said.

“Earnings are up compared to the first half of 2024, even as the coal price has declined, thanks to our continued focus on cost control and execution of our organic growth plans. This outcome demonstrates our low-cost operations’ greater resilience to coal price fluctuations.

“We remain focused on ramping up production at New Acland Mine and sustaining increased production at Bengalla Mine, while continuing our disciplined approach to cost control. Our performance in the first half of the year has us tracking very well in terms of our guidance ranges.”

Strong financials and shareholder returns

New Hope’s underlying earnings rose 22% to $517m, net profit grew 35% to $340m and cash flow from operations climbed a considerable 143% to $317m. The company declared a fully franked interim dividend of 19 cents per share and announced a $100m share buyback.

New Hope company chairman Robert Millner comments on the company’s approach to supporting shareholders as well as its continued cash projections from changes in production.

“The board carefully considers a range of methods to return surplus capital to shareholders and seeks to action those which maximise value,” he said.

“The company expects ongoing cash generation from its operations as we execute our targeted coal production increases, which provides important energy security to our customers and the regions they service.”

Mr Bishop weighed in on returns to shareholders.

“As a result of this performance, we are able to return value to shareholders by way of a fully franked interim dividend of 19 cents per ordinary share. In addition, we are pleased to announce the start of an on-market share buy-back of up to $100m.”

Investing in future growth

New Hope is investing $400m in expanding New Acland and has increased its stake in Malabar Resources to 22.97%, solidifying its position in the metallurgical coal market.

New Hope’s strong production, lower costs and a focus on long-term investment make it well-placed for ongoing success in the coal sector.