LOW uranium prices led to the Honeymoon project being placed on care and maintenance in 2014, but Boss Resources is well underway to restart operations with the DFS expected to be complete by the end of 2019.

From there it’s a case of confirming an offtake agreement to secure financing for the re-start of the project – which is essentially dependent on global uranium prices.

Boss believes the landmark decision of US President Donald Trump to decline issuing quotas for domestic US uranium production is very positive for Australian producers and the uranium market as a whole, as the declined restrictions may have created long term distortions in the market which could have further impacted the recovery of the uranium market.

Mr Trump’s decision is expected to assist unlocking buying activity from US utilities and support uranium price increase – near perfect timing for the restart of the Honeymoon project.

“We welcome President Trump’s resolve as Boss is in a very good position to respond as US utilities come back to the market,” Boss Resources managing director Duncan Craib said.

“We have solid relationships with a variety of US utilities with whom we have been discussing off-take contracts.”

Mr Craib said that Australia has been a long-term reliable and important supplier of uranium to the US and the decision will see this continue, underpinning project development in Australia as well as providing foreign investment.

“The outlook on improved uranium prices is positive,” he said.

“Boss’ 100pc-owned and fully permitted Honeymoon Uranium Project has the same cost structure and restart timeline as most of the tier one and tier two producers with existing and expansion capacity, making it one of the few uranium projects worldwide positioned that can participate in the early stages of a new bull market.

“President Trump’s announcement is timely as Boss advances its restart strategy and continues contractual discussions with US utilities, in concert with the underlying price of uranium.

“We look forward to business as usual in the US without tariffs or trade restrictions.”

Re-start strategy

To ensure a pathway for continued success, a staged approach to restart the Project has been implemented by the Boss Resources board to address the challenges the previous owners had encountered.

Phase one of the Honeymoon re-start strategy was completed in April 2019, generating the final input data required to complete the Honeymoon DFS for production capacity of 2mlb/annum, to be ramped up to about 3.2mlb/annum uranium production.

This phase also includes the drilling program to deliver the measured and indicated resource, an optimisation program to deliver further cost savings and/or process improvements and a preliminary execution plan, updated cost estimate and schedule for the re-start of the existing SX plant.

Phase two is currently underway with the appointment of GR Engineering as Study Manager to complete the DFS engineering works, process engineering design and cost estimation, to deliver an independent feasibility study report.

And finally phase three of the re-start strategy involves detailed execution planning, operational readiness inclusive of the Solvent Extraction (SX) plant recommissioning plan (currently on care and maintenance), in conjunction with the ion exchange plant detailed design.

These staged developmental steps will ensure Honeymoon will be in a position to proceed to mine as one of the first restart competitive global producers.

Mr Craib said that the company is looking to secure an offtake agreement for the Honeymoon project.

“We’re encouraged by our discussions with utilities as Honeymoon is seen as a real and near-term supply prospect, with a cost structure which would make it economic at similar levels to restart recently idled Tier 1 production,” he said.

Once offtake and subsequent financing has been finalised, the company can begin construction of the processing plant and estimates start of production could be as soon as within 1 year.

Exploration potential

Boss has successfully proven up a significant increase in the global uranium resource to 43.5mt at an average grade of 660 ppm eU3O8 (for 63.3mlb eU3O8) above the 250ppm lower cut-off, and has plans to explore the 2595sqkm of prospective land tenure made up of the granted mining lease, five granted exploration licenses, three retention leases and two miscellaneous purposes licenses.

Honeymoon contains a combined exploration target of between 32mt to 78mt eU3O8 at a grade of between 450ppm and 1400ppm eU3O8 with a potential target endowment of between 42mlb and 100mlb of contained uranium.

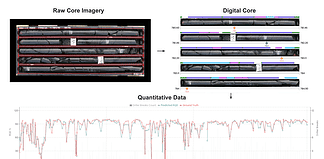

To better understand the geology, mineralisation continuity and volume, Boss conducted advanced 3D geostatistical modelling over the three deposits on the Honeymoon Restart Area – which the company believes will be invaluable in assisting the technical and development teams to understand the orebody from both an exploration and mining perspective.

It will allow for more precise designs of production wellfields, boreholes and specific screen placement in these holes.

“We are really excited with our Exploration Target, and look forward to unlocking additional large-scale uranium mineralisation within the broader Honeymoon Uranium Project,” Mr Craib said.

“This is being made possible by the diligent efforts of the geology department re-analysing historical and recent drill and geophysical results.”

Having multiple wellfields available and online (combined with a modularised plant) allows some flexibility as wellfields can easily be operated and turned off or brought back online depending on target production and more importantly target operating costs.

This significant flexibility in production capacity to seize upon upswings in market prices and readily adjust during the downswings means the Honeymoon project can respond very quickly to changing market conditions and catch the upside of the market cycle by operating from operating in the lowest cost quartile.

Nuclear on the rise

The next five to 10 years look bright for Boss Resources and uranium in general, with demand and acceptance of nuclear energy on the rise.

The World Nuclear Association’s (WNA) projections for nuclear generating capacity growth have been revised upwards for the first time in eight years, following the introduction of more favourable policies in a number of countries.

Nuclear energy has also seen a swing towards a positive rhetoric for its importance for the transition towards a clean and affordable energy system.

With the restart of the Honeymoon project expected to coincide with demand, Mr Craib said “The overall consensus at the WNA Symposium appears to be that the market is on its way to recovery, demand is growing, inventory is falling and prices have to rise to incentivise supply – the longer prices stay low the stronger the upswing.”