Unlocking our energy potential

Australia’s critical minerals processing

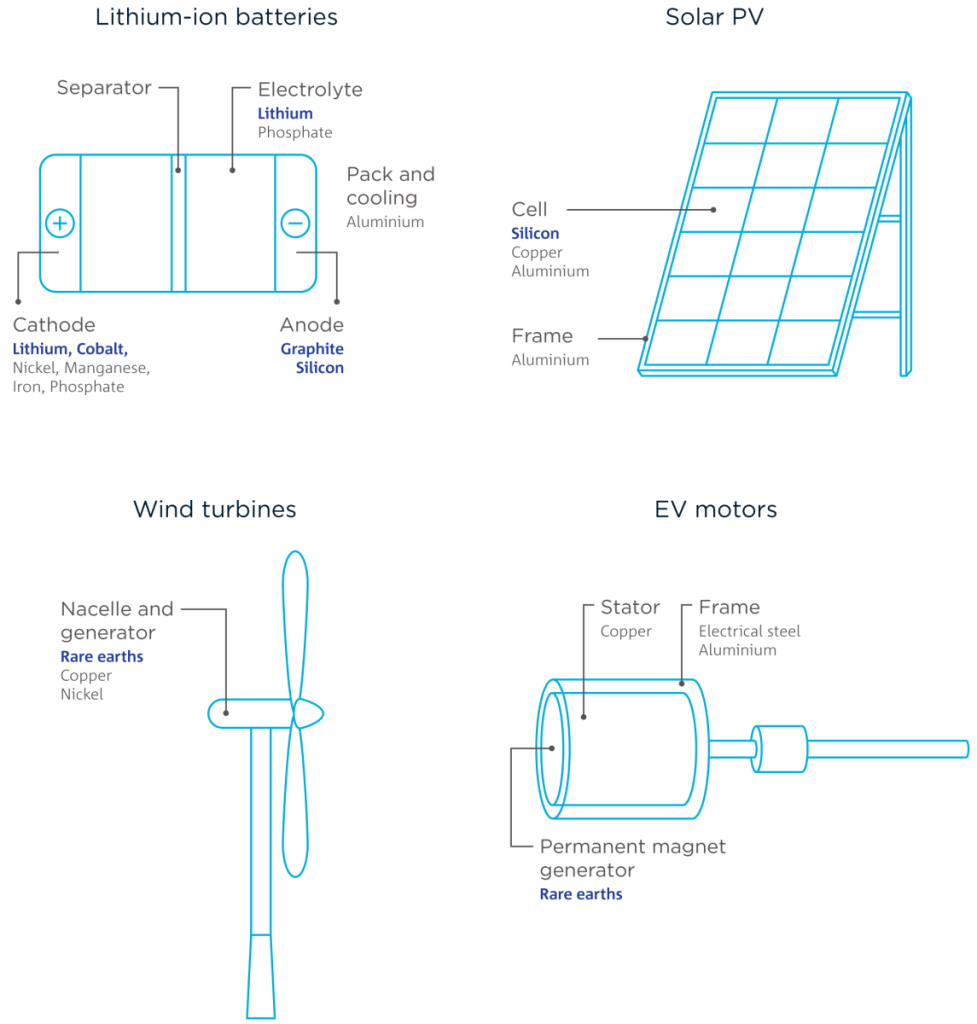

As demand for the energy transition grows, so does the demand for critical minerals that make renewable energy generation and storage possible.

The demand for energy transition materials has doubled in the past five years to $484b (US$320b) led by the exponential growth of electric vehicles (EVs) and the continued deployment of solar and wind energy, according to CSIRO, Australia’s national science agency.

At present, a concentration in supply chains may inhibit the pace at which Australian industry can accelerate its energy transition with these technologies.

Australia needs to build resilience in its critical minerals supply chains, as highlighted in CSIRO’s From Minerals to Materials: An Assessment of Australia’s Critical Minerals Mid-Stream Processing Capabilities report.

The report is the first comprehensive assessment of innovation in critical mineral refining required to build a robust mid-stream processing industry in Australia and provides data on the current capabilities, RD&D and international co-operation opportunities across lithium, cobalt, silicon, rare earth elements and graphite.

The Australian Mining Review speaks with CSIRO Futures minerals lead Max Temminghoff and CSIRO mineral resources science director Dr Louise Fisher about the state of RD&D in Australia and opportunities to bolster resilience and sovereignty in critical minerals mid-stream processing.

State of play

Mr Temminghoff says Australia’s research capabilities paired with its high ESG credentials and regulatory environment can be leveraged to elevate Australia’s critical minerals industry beyond shipping and mining to higher value pathways.

“Processing is concentrated in countries that have invested significant amounts of public money into large scale processing,” he said.

“These traditional processes are quite energy intensive and use chemicals or additives that are quite harmful and, in some cases, banned in Australia.

“Historically it has been quite difficult to compete with that low cost, high output processing.

“To be a global competitor we will have to use innovation to develop and implement new processing techniques and adopt and improve existing ones by considering how we can use less energy or skip processing steps entirely to reduce overall operating costs.

“These breakthroughs aren’t easy and offtakers have been quite happy in the past to purchase these low-cost materials without factoring in the environmental impact of them.

“This is where the opportunity presents itself for Australia.

“Our report shows that our research and industry ecosystem possess world leading capability in the first extractive metallurgical steps especially for lithium, cobalt, graphite and rare earths as well as in the co-production and extraction of graphite.

“We have a very strong research background for these areas and it’s time to start utilising them to take that first step up the value chain.”

Critical minerals endowment

Dr Fisher says Australia is well placed to enhance its midstream processing capabilities.

“If you look at the top 10 minerals and metals in demand for the energy transition, Australia has real strength in its significant endowment of at least nine of those, so the potential to build on the current mining of them and head into local midstream processing is a great opportunity for Australia to realise,” she said.

“In Australia we have a long history of both mining and mineral processing, which means we have built technical strength in developing technologies that can give us productivity and more sustainable outcomes.

“That long history puts us in a strong position to build on our existing strengths down the value chain in terms of developing more value from our minerals and materials.”

Across minerals, the report further identifies opportunities to improve RD&D in Australia by creating diverse supply chains through international partnership, building sovereign capability, using critical minerals to become a renewable energy superpower and extracting value from onshore resources.

Fostering international partnership

To protect a free market of critical minerals and reduce a bottleneck of essential materials, Australia can expand its onshore capabilities by collaborating with international industry partners in the development of more efficient or green processing technologies.

“At the moment a lot of processing happens in China, making it kind of a one-stop-shop,” Mr Temminghoff said.

“This has carry-on effects to supply flow and gives China extra power over the supply.

“By diversifying these supply chains, you can increase cost competitiveness.

“If customers have more choice, then that adds the imperative to improve and make these processes more cost effective, which works out well for the consumer in the end.

“Diversification also allows manufacturers to make long-term investments, as it guarantees long-term supply with several points of failure if one supplier goes offline.”

Building sovereign capability

The report identified opportunities in recycling and reprocessing as pathways for Australia to build sovereignty in its critical minerals industry.

Many critical minerals are locked up in e-waste from old phones, computers and batteries.

Innovative recycling facilities for e-waste not only mitigate environmental and safety risks but can also potentially increase Australia’s reserve of critical minerals while decreasing reliance on international recycling facilities.

Similarly, Australia has a wealth of historic mines that existed in an industry that was uninterested in key critical minerals needed today.

There may be opportunities for reprocessing of remnant materials at these historic or abandoned mines.

“Historically, recycling has been quite limited in Australia due to our low waste volumes and our geographical distance from others,” Mr Temminghoff said.

“While there hasn’t been too much commercial activity when it comes to recycling, we have a strength when it comes to the first steps that are needed for recycling.

“This puts us in a position to be a recycling supercentre for the APAC region where we take on a lot of the e-waste from our neighbours.

“With this, we can start to close that loop and develop a circular economy when it comes to critical minerals without depending too heavily on opening new mines.”

Becoming a renewable energy superpower

A similar circular economy exists within renewable energy and critical minerals production.

Australia can make the processing of critical minerals more environmentally friendly and efficient by employing power from renewable sources.

Increased production capabilities driven by this efficiency then contribute to Australia’s ability to increase renewable energy capture and storage.

“We have so much potential when it comes to both solar and wind power, but to get there we need to purchase or manufacture the solar panels and wind turbines and acquire the copper to make sure it’s all connected,” Mr Temminghoff said.

“To do so, we are going to rely quite heavily on critical minerals.

“This creates a feedback loop: to be competitive in processing critical minerals we need an abundance of low-cost renewable energy made from critical minerals.

“As we further scale up our renewable energy, we can increasingly power these processes, making them greener and continue to supply minerals for future renewable energy deployment.”

Extracting value onshore

Australia’s wealth of skilled workers and research facilities paired with its rich critical minerals resources and healthy mining industry can supercharge its onshore midstream processing industry.

Dr Fisher says that In Australia, there has been a focus on sustainability and development of ESG practices.

“We have a highly skilled workforce and the ability to build on that in terms of heading into more technology focussed jobs,” she said.

“We have a lot of good pathways to take new technologies out into the market through our mining equipment, technology and services (METS) industry to deliver Australian technology globally.”

Mr Temminghoff says traditionally, Australia is a dig-and-ship nation but there have been spurts of more onshore processing and demand for a highly skilled workforce.

“By bringing some of these industries back onshore it enables us to tap into and further develop our advanced mining processing and electrical and chemical engineering specialties,” he said.

“If we can export high value products that means more tax revenue and more advanced skills which is better for our general GDP growth.

“In terms of land use, current and future mines will be operating on Aboriginal land across Australia.

“It’s really important that as we look to increase the number of mines we are engaging extremely closely with local communities and Indigenous groups to see how we can add value to these communities and Australia and ensure everything is done with environmental sustainability in mind.”

Watch this space: in upcoming editions, the Australian Mining Review will be shining the spotlight on critical minerals processing pathways within Australia as highlighted in the CSIRO report.