Bellevue Gold shines with $75m maiden net profit

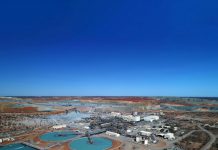

Bellevue Gold (ASX: BGL) has announced a maiden net profit of $75m for FY24 following the start of production at its Bellevue gold mine in WA.

Bellevue generated free cash flow of $41m in the June 2024 quarter from production of 42,705oz, highlighting the cash flow potential of the project as production continues to grow.

Bellevue managing director Darren Stralow says the company has achieved many major milestones during the year as it made the transition to gold producer.

“Production commenced in October 2023, and we are pleased to report profit of $75m for FY24 over the subsequent eight-month production period,” he said.

“This demonstrates the substantial cash flow generating capacity of the project as we grow production and reduce unit costs in the process.

“With the recent successful capital raising enabling us to reduce debt significantly, freeing up cash flow to help fund growth, we are very well-positioned to increase production, cash flow and mine life.”

In July, Bellevue announced its five-year growth plan under which production is forecast to increase to 250,000ozpa by FY28, materially growing the earnings and production profile and reducing the project AISC profile to $1,500-1,600/oz in FY29.

Guidance for FY25 is 165,000-180,000oz at an AISC of $1,750- A$1,850/oz. Production is expected to be back-ended to the second half of FY25 as further development headings and underground advance rates ramp up to an expected run rate of 1.35mtpa by the end of FY25.

Exploration expenditure of $30m has been budgeted for both FY25 and FY26 to drill-test the exploration target of 1.5-2.5moz at 8-10 g/t gold to the south of the deposit.