Moon exploration and mining through the Australian METS sector

Australian companies are being encouraged to showcase their technologies to aid, on a global scale, with off-world or extra-terrestial exploration.

Austmine and AROSE are collaborating with NASA, as the agency looks to the Australian mining, equipment, technology and services (METS) sector for solutions to “space mining”.

Shortlisted companies will have the chance to present their solutions at the NASA-USGS Workshop in San Jose, California in May, offering exposure and recognition on an international platform.

Over the past year, there has been a notable increase in interest from both the Australian Space Agency and NASA in the mining and METS sector.

This heightened interest reflects the recognition of the overlap between space exploration and mining operations, presenting opportunities to expedite future mission design leveraging Australia’s expertise in minerals exploration here on Earth.

In addition to showcasing our nation’s capabilities, Austmine and AROSE are eager to learn alongside NASA as they adapt technology for lunar exploration, further advancing capabilities for both.

Austmine chief executive Christine Gibbs Stewart says that “exploring with NASA underscores the exceptional capabilities, world leading reputation and innovative spirit of the Australian METS sector”.

“This workshop provides a unique opportunity for the Australian METS sector to demonstrate not only their expertise in mining technology but also how these innovations can be applied in the challenging environment of space exploration,” she said.

“By participating and submitting their innovative ideas to these challenges, Australian companies are not only showcasing their capabilities to NASA but also are further positioning themselves as technology leaders no matter what the environment.”

AROSE program director resource and space Michelle Keegan says, “this showcase will not only offer NASA the ability to understand our capabilities, but also provide the METS sector a unique path to innovate for their ongoing work here on Earth”.

The NASA opportunities will be hosted on Austmine’s innovation platform, mineinnovate, providing a dynamic space for collaboration and solution development within the METS sector.

- Detecting and assessing minerals on the moon for off-world manufacturing

NASA’s SpacePortal is looking for solutions capable of detecting, measuring, and mapping critical lunar minerals such as zirconium, barium, fluorine and sodium. This endeavour aims to facilitate off-world manufacturing by creating high-quality materials in the unique conditions of space.

- Reducing geologic uncertainty through multi-sensor data fusion

NASA’s Ames Research Center, in collaboration with the United States Geological Survey (USGS), seeks improved methods for fusing data from multiple sensors to enhance geological interpretation in space. This initiative aims to reduce uncertainties associated with current single-modality measurements.

- Advancing off-world SLAM (simultaneous localisation and mapping)

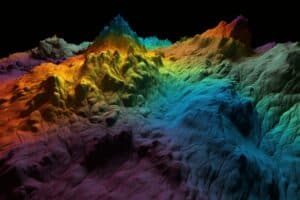

The prospect of sustained human presence off-world necessitates autonomous systems capable of conducting intricate tasks, including excavation, above and below the lunar surface. NASA Ames is looking to discover the most accurate system of near real-time surveying that produces accurate 3-Dimensional point clouds of evolving lunar topography.

For more information and to find out how to get involved, visit: www.mineinnovate.com.au