BHP builds up for big finish in FY25

BHP (ASX: BHP) had a strong start to FY25, with the company expecting an enduring competitive advantage, thanks in part to its portfolio of commodities linked to global megatrends such as population growth, data centres and AI and the energy transition.

According to BHP, demand for commodities in the developed world continued to be soft in CY24 as sluggish industrial activity persisted. However, the company expects recovery for steel and copper demand across the OECD in the near-term.

Still, BHP says potential trade tensions present a risk to the recovery in developed economies and across the globe.

“Over the long term, population growth, urbanisation, rising living standards, and the infrastructure required for digitisation and decarbonisation are all expected to drive demand for steel, non-ferrous metals and fertilisers,” BHP said in a statement.

“We believe that China’s economic transition could also accelerate its demand shift increasingly towards ‘future-facing commodities’.”

BHP chief executive Mike Henry says the demand for the company’s products remains strong despite global economic and trade uncertainties, with early signs of recovery in China, resilient economic performance in the US and strong growth in India.

“The trajectory of the world population growing from eight billion today to 10 billion in 2050, with more people living in cities, together with the energy transition and the growth of data centres and AI, will compound the need for more metals and minerals,” he said.

“Against this backdrop, BHP is well-positioned, with the ability to leverage our strong balance sheet, technical know-how and sustainable business practices to deliver growth and resilient shareholder returns.”

Mr Henry says the company reported a strong financial performance for H1 FY25, underpinned by safe and reliable operations and rigorous cost control.

“The group’s industry-leading margins and robust cash flow enabled the board to determine an interim dividend of [about $0.79] US$0.50 per share — a total of [about $3.9b] US$2.5b,” he said.

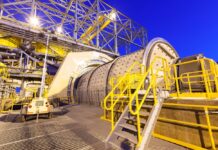

“The strength of the result demonstrates BHP’s operational resilience and its ability to perform through the cycle, with standout production performances in the half from Escondida, WAIO and BMA.”

BHP plans to increase production to more than 305mtpa (100% basis) at WAIO over the medium-term, underpinned by the Port Debottlenecking Project 1which was delivered in CY24, enabling record first-half tonnes shipped from the port, as well as the Rail Technology Programme.

The company is assessing options to grow its WAIO production up to 330mtpa (100% basis) if market conditions warrant, including studying optimal mine and infrastructure configurations and potentially increasing ore beneficiation. BHP expects to complete these studies in CY25.

“WAIO has maintained its lead as the lowest-cost iron ore producer globally, a testament to our ongoing work to drive productivity at our operations,” he said.

“We continued to invest in growth, including [about $5b] US$3.2b in potash and copper, and have now also successfully completed the [about $3.1b] US$2.0b formation of Vicuña Corp, a 50/50 joint venture with Lundin Mining to develop the combined Filo del Sol and Josemaria copper projects in an exciting prospective region in Argentina.

In Brazil, Samarco is set to double production capacity following the restart and ramp up of a second concentrator.

After increasing copper production by 19% from FY22 to FY24, BHP delivered a 10% increase in HY25, including a 10-year production record at Escondida as the company mined higher grade ore and further lifted productivity across all copper-producing assets.

BHP is growing at its 100% owned Copper South Australia asset, with growth projects across all three operations. The company is assessing the pathway to deliver more than 500ktpa of copper production in the early 2030s and a strategy to deliver up to 650ktpa copper production by the middle of next decade. This is supported by the recent exploration success at OD Deeps and at Oak Dam.

The company also expects some organisational changes, with BHP announcing that BHP chair Ken MacKenzie will retire from the board.

“Ross McEwan will succeed Ken MacKenzie as chair on March 31, 2025,” Mr Henry said.

“We thank Ken for the instrumental role he has played in shaping BHP and look forward to Ross’ leadership as chair of BHP.”