FMG banks record shipments, backs down on green hydrogen

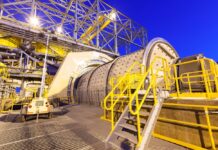

Fortescue (ASX: FMG) has documented record annual iron ore shipments for FY25, totalling 198.4mt, 55.2mt of which was shipped during the June quarter.

The company also mined 64.2mt and processed 54.4mt, a respective 16% and 14% increase from the previous quarter.

Fortescue chief executive Dino Otranto says the company’s performance for the year has been exceptional and is credited to the relentless focus of its teams on safety, efficiency and operational excellence.

“We met all aspects of our market guidance and cemented our position as the industry’s lowest cost producer, with our annual C1 cost declining for the first time since FY20,” he said.

“As we look to FY26, we’re focused on building on this momentum — safely ramping up Iron Bridge, breaking new production records and accelerating our decarbonisation efforts, including the advancement of green iron.”

“Having returned from China last week, it’s clear there is strong support from both Australia and China to collaborate on a green iron and steel supply chain which would drive investment, strengthen trade ties and eliminate emissions at scale,” Mr Otranto said.

Fortescue’s green hydrogen projects however, have taken a hit. Following a detailed review, the company has decided not to proceed with its Arizona hydrogen project in the US and PEM50 project in Gladstone, Queensland.

An assessment is currently underway to repurpose the assets and the land.

Fortescue anticipates the decision to terminate the projects will cost the company $227m, relating to the expenditure on the PEM50 project, electrolyser manufacturing in Gladstone and engineering costs for the Arizona project.

Fortescue growth and energy chief executive Gus Pichot says the company’s operational excellence is driven by its push to decarbonise, innovate and evolve.

“Over the past year we have refined and reconsidered our global project pipeline with a sharpened focus on commercial outcomes,” he said”.

“That’s meant making some tough decisions.

“We remain committed to disciplined growth, underpinned by targeted research and development that unlocks innovative solutions to drive down costs and deliver our green metals and green energy goals.”

Fortescue’s green energy project pipeline continues to be progressed and refined in a disciplined manner that reflects global market conditions and policy settings.