RTS highlights industry-wide concerns

This week in Perth, WA, key industry representatives addressed some major challenges the Australian mining industry is facing at the Resources Technology Showcase.

Concerns surrounding the feasibility of global green steel production amid challenging industry conditions, oversupply, low ore grades, approval delays and low ore prices, were prominent.

BHP (ASX: BHP) WA iron ore asset president Tim Day says getting the costs of smelting iron ore using lower emissions fuels to compete with traditional blast furnaces is at least 10 years away.

“It is very hard to compete against an established industry and making the industry commercial in Australia is proving harder than overseas,” he said.

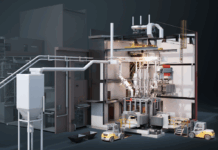

BHP, alongside Rio Tinto (ASX: RIO) and BlueScope, are currently developing Australia’s largest ironmaking electric smelting furnace (ESF) pilot plant as part of the NeoSmelt project.

“We’ve got agreements and partnerships with nearly 20% of all steelmakers so we’re heavily invested in green steel to work out new technology and make sure we can find ways to do it as soon possible,” Mr Day said.

“When it comes to Australia’s perspective we’re investing locally, but the economics are just more complicated, because its more expensive.”

If successful, NeoSmelt has the potential to unlock longer term alternatives to the traditional blast furnace steelmaking route and help ensure the longevity of Australia’s iron ore industry.

On day two of the forum, panellists expressed concerns approval delays are slowing down Australia’s resources industry.

According to the Minerals Council of Australia (MCA), there is industry-wide concern that long lead times for approvals are hindering Australia’s resources sector as timely decisions are essential to attracting and retaining investment.

Sandfire Resources (ASX: SFR) chief executive Brendan Harris says Sandfire’s Spain and Botswana operationshave avoided much of the cost inflation and regulatory approval logjams plaguing Australian mining operations in recent years.

The WA Department of Mines, Petroleum and Exploration (DMPE) has a target of completing 80% of approval assessments within 30 business days.

According to a report published by DMPE, Assessment timeframes for mining environmental application 2023-24 analysis, in FY24 only 42.4% of approvals were completed within the 30-day target period.

“We haven’t had anywhere near the level of inflationary pressure in our industry in those two locations over the last two to three years [compared to Australia],” Mr Harris said.