Bringing home the medal

Sharing similar geological properties, gold and copper are often found within the same deposits. With gold prices at an all-time high and copper demand rising in the face of the energy transition, this natural occurrence has never been more beneficial.

Optimising resource utilisation is a goal of every miner. One way this can be done is by diversifying the minerals extracted from one site. Gold and copper are emerging as ideal candidates for Medallion Metals (ASX: MM8).

Medallion’s flagship Ravensthorpe project is situated on the historical Kundip Mining Centre (KMC), halfway between the Ravensthorpe and Hopetoun regional centres in WA.

Ravensthorpe currently boasts an expanded mineral resource estimate of 19.5mt at 2.1g of gold and .3% copper for 1.3moz of gold and 59,000t of contained copper metal.

The resource base has grown by .86moz gold equivalent in under two years, indicating the site’s exceptional growth potential with further upside from shallow, open extensions and highly prospective regional targets.

Recent drilling at Kundip delivered standout intercepts, including 7.8m at 17.4g/t gold, 1.5% copper and 6.6g/t silver, underpinning project confidence.

The project has a robust production outlook, with a pre-feasibility study (PFS) confirming its potential nine year mine life, delivering an annual average of 85,000oz of gold and 1800t of copper with pre-tax annual cash flow projected at $85m.

Ravensthorpe’s location gives it a strategic infrastructure advantage that is easily accessible by sealed roads and a sealed airstrip 10km south of the projects centre.

Medallion is targeting final investment decision (FID) in late 2025. The project is fully permitted on granted mining leases, with strong community support and a clear path to development, minimising regulatory risk.

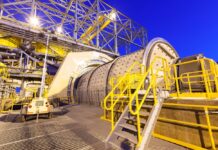

Medallion has reached a significant milestone on the pathway to production from Ravensthorpe with processing at Forrestania as Medallion and IGO have executed an asset sale agreement that sets out the terms and conditions for its acquisition of the Forrestania nickel operation (FNO).

Under the agreement, Medallion will acquire a 100% legal and beneficial interest in all FNO tenure inclusive of the Cosmic Boy plant and equipment, infrastructure, inventories and information including mineral rights other than reserved rights.

IGO will reserve the right to explore for, develop and mine nickel and lithium minerals across the tenements and will retain the mining information relating to such minerals.

Medallion Metals managing director Paul Bennett comments on the acquisition.

“Medallion is pleased to achieve this significant transaction milestone,” he said.

“The company now turns its focus to the development of a new gold and copper producer in WA.

“Bringing the established high-grade gold-copper resources at Ravensthorpe together with the Forrestania plant and infrastructure can unlock significant value in the short term, with a substantial option on future growth from the new discovery potential of the tenure at both Ravensthorpe and Forrestania.

“Study work is at an advanced stage, permitting is being progressed as a priority and discussions continue to advance positively with offtake and finance parties.

“We expect to provide positive updates on all these key work streams in the near term as the business advances toward a decision to proceed with this exciting development opportunity.”

Medallion Metals appointed Ian Gregory as geology manager, bringing direct experience with respect to the FNO ground holding.

Mr Gregory has more than 30 years’ experience in minerals exploration, primarily in gold, nickel and lithium, having held senior roles in numerous ASX-listed companies. Most recently, he was exploration project manager at IGO and prior to that, Greenfields exploration manager at Western Areas (ASX: WSA).

This recent and relevant experience will be critical in advancing Medallion’s gold discovery efforts at FNO and as the company seeks to rapidly implement the sulphide development strategy.

Mr Bennet comments on the appointment.

“On behalf of the board, I’m pleased to welcome Ian to the Medallion team as the business prepares for a transformational period where the Ravensthorpe and Forrestania assets are brought under a single corporate entity with a singular focus on gold,” he said.

“Ian’s recent and relevant experience will be critical to unlocking the immense potential of the two greenstone belts that Medallion will hold dominant positions in.

“I look forward to working closely with him to generate an outstanding outcome for Medallion shareholders.”

At the time of printing, an updated Mineral Resource Estimate (MRE) is expected for release in August, incorporating the results of the recently completed 17,000m drill program undertaken at KMC. Medallion expects to release metallurgical recovery and metal deportment assumptions that will inform the feasibility study in coming weeks.

Prior to Medallion’s execution of the binding asset sale agreement with IGO, Mr Bennett spoke with The Australian Mining Review about the company’s path to production.

AMR: Given the volatility of gold and copper prices, what strategies does Medallion Metals intend to employ to maintain stability and ensure long-term profitability and sustainability?

PB: The company doesn’t view gold or copper to be particularly volatile commodities; however, there is a recognition that prices don’t always go up.

The relatively high value ore stream the project will produce is significant in terms of protecting against lower price environments.

The scoping study forecast all-in sustaining costs of $1845/oz gold which provides for a significant margin over current spot prices. In addition, the current phase of the project is critical as it will be the decisions made during feasibility that ‘bake’ cost structures into the future so we are cognisant of that in our decision making and are always looking to future proof the assets.

No decisions have been made at this stage as it relates to implementing price protection. Hedging is not a requirement of any financing proposals the company has reviewed to date.

AMR: How might the Forrestania acquisition influence the long-term strategy for Medallion Metals?

PB: Medallion believes there is a substantial gold opportunity within the Forrestania tenure, a region that has had a nickel focus for over a generation with no modern technology or budget directed to gold exploration across the ground holding.

This represents a significant opportunity to increase the production profile of the project when gold processing capability is established at Forrestania in addition to expected mine life extension at Ravensthorpe and the ability to treat third party ore within economic trucking distance.

AMR: Casting an eye towards the future, beyond your targeted FID in Q4 FY25, what’s the forecast for gold and copper production from the Ravensthorpe gold project (RGP)?

PB: The scoping study forecast an average production rate of 70kozpa gold equivalent over the 5.5 year mine life from RGP. That was based on target throughput rate of 500ktpa from Forrestania.

The feasibility study will model a process plant capable of 650ktpa. Scheduling hasn’t commenced yet and we are yet to see if the mine will keep up with the plant at that rate. Whatever capacity is available in the plant will be open for any production sources identified on the Forrestania ground or from third party deposits within economic trucking distance.