Attracting innovation for rare earths

Midstream processing in Australia

In the third instalment of the Australian Mining Review’s critical minerals series, we speak with CSIRO senior principal research scientist Chris Vernon, ANSTO principal consultant Karin Soldenhoff and Australian Critical Minerals R&D Hub manager Lucy O’Connor for a deep dive into emerging mid-stream processing pathways for rare earths (RE) needed to achieve net zero emissions by 2050.

In the third instalment of the Australian Mining Review’s critical minerals series, we speak with CSIRO senior principal research scientist Chris Vernon, ANSTO principal consultant Karin Soldenhoff and Australian Critical Minerals R&D Hub manager Lucy O’Connor for a deep dive into emerging mid-stream processing pathways for rare earths (RE) needed to achieve net zero emissions by 2050.

Rare earths are a critical input for electric vehicle (EV) and wind turbine supply chains, playing a foundational role in the global energy transition. As demand for renewable technology increases domestically and globally, the RE market is also expanding, with the previously overlooked materials becoming increasingly attractive.

By investing in domestic mid-stream processing capabilities highlighted in Australia’s national science agency, CSIRO’s, From Minerals to Materials: An Assessment of Australia’s Critical Minerals Mid-Stream Processing Capabilities report, Australia can contribute to global risk reduction and capability development to support a successful and advantageous energy transition.

Dr Vernon says supply chain concentrations offer an opportunity for Australia to leverage its position as an alternative supplier of RE products.

“There was a time in history where we as a planet, didn’t need RE in such quantities as we do now — they were a bit of a curiosity,” he said.

Ms O’Connor says the RE supply chain has become concentrated in China.

“China dominates the RE value chain, having built an end-to-end capability over many years — from mining, oxide separation, metal refining to production of high value industries for components essential to modern technologies,” she said.

“It is estimated that China currently produces 92% of RE magnet production.

“The IEA predicts demand for RE to support wind turbine growth alone will triple by 2040.

“The accelerating demand for these components, particularly those essential to renewable energy and decarbonisation, is driving further concentration of an already concentrated supply chain.”

Ms O’Connor says diversification of supply chains is essential to ensure security of supply, improve ESG credentials of RE production and achieve net zero targets.

“Australia currently produces 5% of the world’s RE and has significant geological potential to increase production,” she says.

“Market distortions stemming from China’s dominance makes it difficult for Australian mining projects to attract investment.

“The growing market for RE, Australia’s resource endowment, processing expertise and global demand for high ESG sources of supply all create an opportunity for Australia to become an alternative supplier of mid-stream RE products.”

Mature technologies across the key stages of mid-stream processing — extraction, separation and metallisation — support the existing, commercially established global RE supply chain. But Australia can still catalyse major innovation in the supply chain, with improvements to efficiency and sustainability in existing and emerging technologies.

Mixed RE compounds: monazite and xenotime

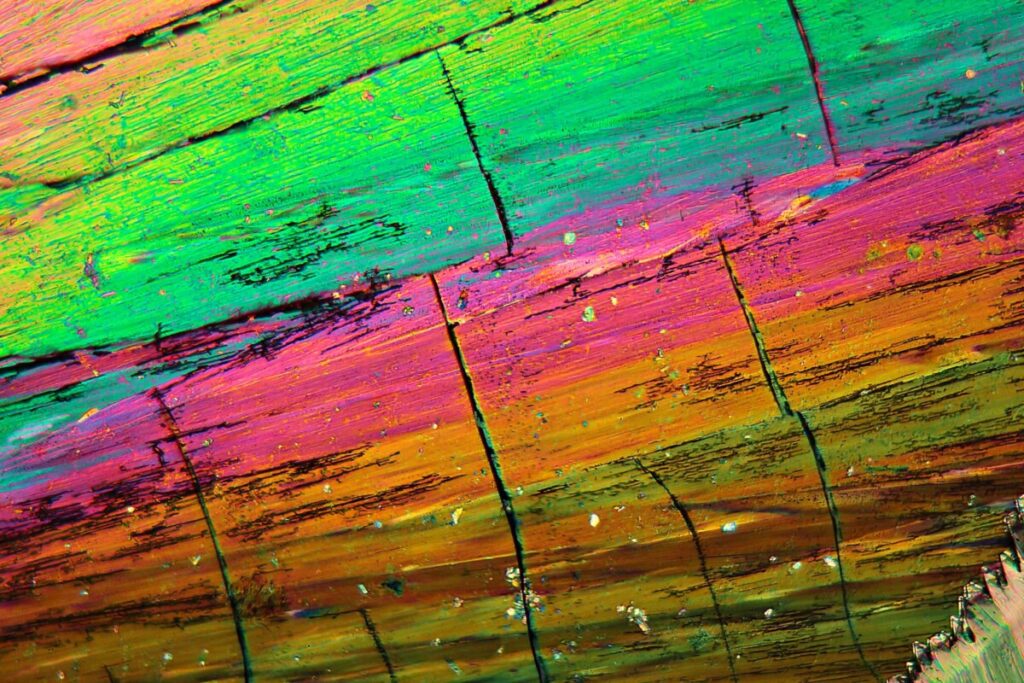

Australia has an estimated 2.98mt of monazite and xenotime reserves, two key rare earth element (REE) resources. Monazite, a RE phosphate mineral, contains a mixture of light RE such as lanthanum, cerium, neodymium and samarium, while xenotime is rich in heavy RE like yttrium, dysprosium and terbium. These elements are needed for magnets in EVs, wind turbines and in electronics.

Despite a wealth of these REEs in Australia, processing of monazite and xenotime is tricky. Monazite and xenotime are refractory minerals, meaning they are resistant to change under normal chemical and temperature applications used in separation processes.

“A lot of the RE minerals are incredibly stable, so you might have to heat them with sulphuric acid or another treatment,” Dr Vernon says.

“There are various chemical steps that are required to take out the things like the iron, aluminium, the calcium and whatever else is in there, until you get to a stage where you have more or less pure RE in solution as either sulphate or chloride or some other soluble form, and then you precipitate them.”

While the technology to achieve separation is mature, CSIRO and ANSTO are working to solve the technical and environmental challenges within existing practices.

Sulphuric acid roasting or baking

Sulphuric acid roasting or baking is a globally mature technology with commercial use in Australia.

Dr Soldenhoff says about 50% of RE ores and concentrates are processed globally using sulphuric acid technology.

“The acid is used to attack and decompose the mineral matrix at elevated temperatures,” she said.

“By doing that, the RE are converted into RE sulphates which can then be dissolved in water.

“There are a number of impurities such as aluminium and iron that are also dissolved and the next steps are designed to remove these impurities and finally precipitate a mixed RE chemical concentrate.

“At this stage, you’ve got rid of all the minerals and all the elements that you don’t want, and you’ve then concentrated all the RE together into a purified mixed chemical concentrate.”

Despite its commercial uptake, sulphuric acid roasting and baking faces several challenges including high waste and equipment corrosion.

The technology is widely compatible with various RE, making its risk for adoption low due to its versatility. However, RD&D is needed in Australia to address high temperature requirements, acid concentrations, waste reduction and corrosion prevention.

Alkaline baking

Alkaline baking follows a similar method to the sulphuric acid baking and roasting but utilises less corrosive caustic materials during the process. Compared to sulphuric acid roasting and baking, alkaline baking is less energy intensive due to lower temperatures. However, the pathway requires high grades of monazite concentrate, making it less versatile than the sulphuric acid pathways.

“In the caustic bake, the caustic does affect iron, it affects stainless steel, but far less than sulphuric acid,” Dr Vernon says.

“Sulphuric acid, at those temperatures and concentrations is incredibly vicious, whereas caustic soda is nowhere near as corrosive, so it’s just fundamentally less of a problem with materials of construction.”

Despite limited commercial deployment globally, Australia may have ore grades suitable for alkaline baking, opening avenues to deploy the potentially more sustainable and cost-effective process.

Separated RE oxides

Once pure mixed RE chemical concentrates are obtained, they need to be further separated into each individual RE element.

Demand for RE oxides is expected to grow from 171,300t in 2022 to 238,700t by 2030, with global shortages expected by 2040, making improvements to separation of REE necessary for global supply chain security.

Solvent extraction

Solvent extraction uses solubility differences to separate components of a liquid mixture. Many rounds of solvent extraction are often required, with each round separating one element or impurity from the mixture at a time.

“The RE really do not play well,” Dr Vernon says.

“Once you have a concentrate of RE, you — surprise, surprise — dissolve it up again into soluble format using solvent extraction.

“It’s almost like distillation — in fact, people who do solvent extraction draw the same diagrams as engineers who do distillation, because you fractionally improve the concentration of one or more of the RE on one side and they decrease on the other side.

“You do that over and over and over again until you end up with only one, or the mixture that you want of the RE.”

Solvent extraction is the preferred technique for REE separation due to its selectivity. However, efficiency of the process could be massively improved.

While extraction is a commercially proven and scalable process for the separation of RE, its domestic deployment has been restricted, due to its high complexities and a lack of knowledge sharing by industry.

Dr Soldenhoff says that while these are quite challenging and complex separations, the technology for solvent extraction itself is well proven.

“Everybody knows what solvents are used and essentially what the approach is theoretically, but the know-how in order to actually make it happen is something which is very closely guarded by the companies that carry out these separations,” she said.

Work in this area is ongoing. Recently, Australian Strategic Materials (ASX: ASM), in collaboration with ANSTO, developed and demonstrated a solvent extraction process at pilot scale for production of terbium and dysprosium, two highly valued magnet RE. More work will need to be done domestically to optimise efficiency and sustainability via the development of novel solvents and processes.

RE metals

Once separation is complete and RE oxides are obtained, they can be processed into metals to be used for magnet manufacture.

Metallisation techniques often differ between light and heavy RE but given their mutual importance for magnets used in EVs and wind turbines, development and investment across processing methods is necessary to ensure continued supply of both.

Metallisation of RE is extremely limited outside of consolidated Chinese companies, but Australia has opportunities to pilot and demonstrate onshore technology. Further RD&D is needed to ensure sustainable and safe domestic operations.

Electrochemical reduction

Electrochemical reduction is the premier process to produce light RE metals, namely magnet-relevant neodymium and praseodymium. While broad electrochemical reduction methods are mature globally, their application to RE is concentrated in China, limiting shared know-how.

In electrochemical reduction, the REE of interest is reduced by an electric current passing between two electrodes which are immersed in an REE solution. The reduced REE is then deposited on the cathode as a metal. The conventional and commercially mature process is molten salt electrolysis, but there are emerging approaches that do not use molten salts.

Molten salt electrolysis is the commercially mature method of electrochemical reduction. This process dissolves RE oxides in molten fluoride or chloride salts. This is a scalable, continuous process with lower temperature and energy requirements than metallothermic reduction.

Improvements can be made to reduce the number of steps in the process via the production of master alloys. According to CSIRO, new research is being directed towards producing a neodymium-iron master alloy, a direct precursor to neodymium-iron-boron permanent magnets.

Metallothermic reduction

Metallothermic reduction is primarily used to produce heavy RE metals. Like electrochemical reduction, the technology is concentrated in China.

In metallothermic reduction, a RE compound is reacted with an active metal at a high temperature to produce an RE metal. Alkaline elements like lithium, sodium, potassium and calcium can be used as the reductant metal.

RD&D is needed to target opportunities for equipment cost reduction, improve availability of sufficient high-purity reductants and reduce risk of impurities that require additional steps.