Element 25 expansion essential for energy transition

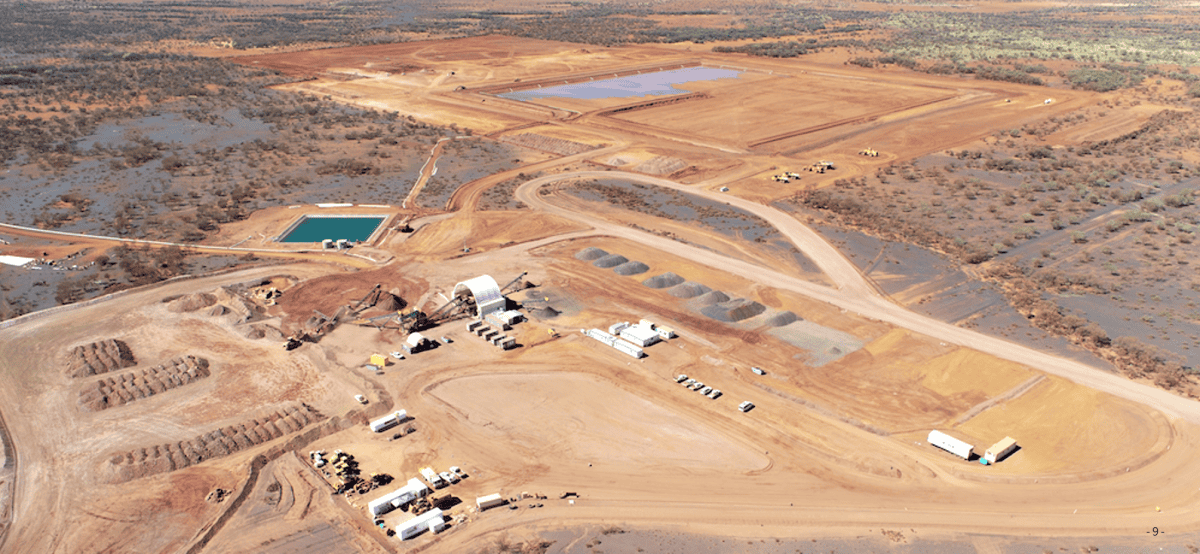

Element 25 (ASX: E25) is expanding its Butcherbird processing facility in WA to 1.1mtpa of manganese oxide concentrate.

This follows the release of its January 2024 feasibility study (FS) which demonstrated potential for robust economic returns and rapid capital payback. Element 25 has commenced detailed design, planning and procurement for the Stage 2 expansion project.

Expansion of the Butcherbird processing facility is an important step in providing feedstock for the planned battery-grade high purity manganese sulphate monohydrate (HPMSM) project to be built in Louisiana, USA. The refinery will be the first ever north American HPMSM facility in partnership with General Motors and Stellantis, two leading global manufacturers of future-facing electric vehicles (EVs).

The Australian Mining Review speaks with Element 25 managing director Justin Brown about the development of the Butcherbird manganese project.

AMR: We have recently seen increases in manganese ore prices as manganese has become higher in demand due to expansion in EV technologies in countries such as the US that import 100% of their manganese. What does future demand for manganese look like?

JB: Manganese is an element that goes into traditional industries like steel making but is also an important part of the EV battery raw supply chain. Manganese is becoming increasingly important as original equipment manufacturers (OEMs) seek to derisk their battery raw materials supply chain which have historically relied on high-risk commodities like cobalt and nickel, sourced from parts of the world which aren’t as geopolitically stable and potentially high risk from an ESG and supply security perspective.

Manganese is available from a wider range of sources including Australia which produces, in the case of the Butcherbird project, manganese to a very high environmental standard which is ideal for the battery raw materials supply chain where OEMs are looking to get large volumes, lower costs and also maintain stringent environmental and social governance standards as they chase ESG targets and also look to decarbonise.

Manganese is floating to the top because it offers a lot of things that the nickel and cobalt supply chains can’t offer. We are seeing a transition to higher utilisation of manganese in cathode materials in the market. Some of the cathode materials coming to market now have up to 70% manganese content in them at the expense of nickel and cobalt. That bodes very well for demand in the high purity manganese sulphate space which is what Element 25 is going to produce from its refinery in Louisiana.

AMR: Can you tell us more about your progress and expectations for the Stage 2 expansion project and its role in providing feedstock for the planned battery-grade (HPMSM) project in Louisiana, USA?

JB: Butcherbird is interesting because of its sheer size. It has a huge in-ground resource of about 263mt. As we speak, we are drilling out a portion of that to underpin a very long life producing asset. The 1.1mt expansion does a few things. It increases the business robustness of the project because it brings our costs down through economies of scale. It also generates better returns as an ore business but also provides a reliable long-term supply for not just the Louisiana refinery but eventually for battery grade manganese refineries in other parts of the world potentially including the EU and Japan and Korea. In line with our design-one-build-many philosophy, we will have a hub and spoke approach to supplying ore from Australia to multiple refineries globally and that expansion is an important part of that overall supply chain security for vehicle OEMs.

AMR: The FS on proposed project expansion outlined strong economic returns. What returns can Australians expect to see from these developments?

JB: At the moment, all the returns are going to benefit our Australian shareholders because the mine is 100% owned by the parent Element 25 Limited The refinery in the US is wholly owned by a subsidiary of Element 25, Element 25 Louisiana. Whilst that will be a business in its own right, the ultimate profits will flow back to Australian investors.

The mine itself as a standalone business is very robust, as you’ve seen in the feasibility study released earlier this year. The high-purity manganese sulphate refinery in Louisiana also stands on its own two feet as a robust profit centre for the global group as well. Those benefits are going to flow back to our shareholders here on the ASX from either point.

AMR: Are there any benefits to being based in Australia that sets you apart from other providers whether related to your access to geology or the local community?

JB: WA’s geology is second to none. We are very well-endowed with mineral resources and manganese is no exception so that is part of the reason we have such a large resource at Butcherbird.

WA is also a well-established mining jurisdiction. We have a very highly regarded regulatory framework which allows mining to be conducted to a high environmental standard. WA has good infrastructure; in our case we use the Port Hedland export port facility to take all our ore to the global markets.

Australian manganese is well regarded as a high-quality, ethically produced source of raw materials for these battery supply chains. Geopolitically, Australia is very stable and has great relationships with the US both through the Australia-United States Climate, Critical Minerals and Clean Energy Transformation Compact. Eventually what we would like to do is build similar refineries in Europe to service that part of the world and then Asia as well to service their EV industries.