How Australia can take its nickel-back

Occurring exclusively in the Earth’s crust and core, nickel is one of the most versatile metals found on the planet. It’s used in various alloys, including stainless steel, electroplating and most recently, lithium-ion batteries.

Nickel is corrosion and oxidation resistant, fully recyclable and highly ductile. It plays a critical role in enabling the transition required to reduce CO2 emissions.

Nickel can be found across the entire spectrum of clean energy technologies, including geothermal, batteries for electric vehicles, energy storage, solar, wind and hydro.

According to the International Energy Agency, nickel demand is expected to increase 2.1 times by 2040 to meet the need for energy storage and electric vehicles.

Due to the rise in electric vehicles, the International Nickel Study Group reported an increase of world nickel demand from 1.12mt in 2000 to 2.38mt in 2020, with a yearly average growth rate of 3.8% since 2000.

Since 2023, the London Metals Exchange (LME) benchmark nickel prices have fallen considerably as the supply of nickel from Indonesia significantly increased and the LME began accepting Indonesian-origin nickel products.

At the time of print, the LME nickel price was hovering around $24,254/t (US$16,035/t), coming down almost 50% from the $44,000/t (US$30,000/t) it was trading at in early 2023.

The price drop can be attributed to reduced demand and an increasing surplus of the metal from Indonesia, the world’s largest nickel producer.

The Australian Mining Review speaks with Monash University’s Professor David Whittle and Dr Parama Banerjee about Australia’s nickel industry, its future and how the university is developing new technologies to extract this metal from other minerals.

“The slump in the nickel industry can be attributed to a lot of new supply coming in from Indonesia and the processing of a low-quality product, not a battery-grade product, from Chinese-backed firms,” Prof Whittle said.

Professor David Whittle.

After Indonesia banned nickel ore exports in 2020 to ensure more downstream processing and value-capture from its resources, China-based companies stepped in to ensure continued control of critical parts of the nickel supply chain and take advantage of the cheaper labour and energy costs in the country.

According to Prof Whittle, there are concerns surrounding the environmental and social aspects of Indonesia’s nickel mines.

“Regarding the supply that comes from Indonesia, concerns have been raised about product coming from the country with there being high damage to the environment and waterways in the country surrounding these nickel mines,” he said.

“There’s also allegations of very unsafe working conditions as well as very poor pay.”

Australia’s nickel industry

Prof Whittle says that “according to Benchmark Mineral Intelligence, less than 30% of the world’s nickel production is associated with good reporting on ESG matters”.

“Nickel West and Glencore’s Australian operations would fit into that 30% as they do the right thing from an environmental, employment and social perspective, but 70% of the world’s nickel is not produced to that standard,” he continued.

“If these Australian mines are pushed out permanently and go into closure and rehabilitation, then they’ll never come back into the market.

“That means when prices do rise, the profits will be far greater for those who have managed to remain in business.

“If the current surge in production is being done with the intent of pushing competition out of the market permanently, that could be considered anti-competitive behaviour.”

One way this could be combatted is by building infrastructure in Australia to keep a larger amount of the nickel production in the country, however, this comes at a cost.

“More than just the ESG aspects, if you want to build infrastructure in Australia, compared to building in China, it’ll cost between 3-10 times more in Australia – that’s the cost of doing business in Australia,” Prof Whittle said.

“On the other hand, Australians are good miners and so despite those constraints, they manage to run highly profitable mining operations under the right conditions.”

In an attempt to combat these unfavourable factors, the Federal Government placed nickel on the Critical Minerals List in February 2024 with the move intending to give nickel companies the opportunity to access billions of dollars in funding.

The decision to place nickel on the list means that companies will have access to financing under the $4b Critical Mineral Facility and critical minerals-related grant programs such as the $40m International Partnerships Program.

Hitting close to home

In mid-July 2024, BHP (ASX: BHP) announced it would be temporarily suspending its WA nickel operations as a result of the global oversupply of the material.

The transition period began with the mining giant stating operations would be suspended in October and handover activities for the temporary suspension would be completed by December this year.

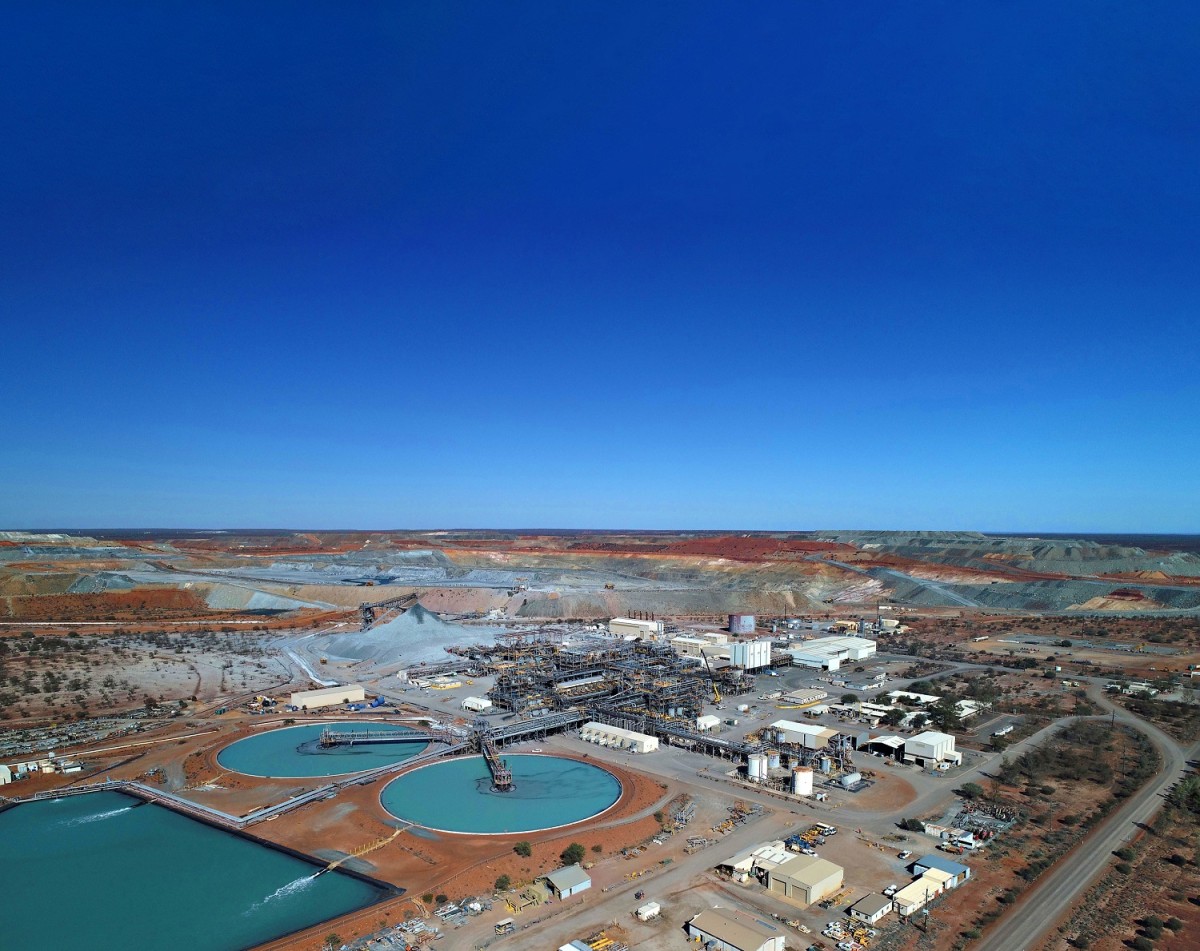

During the transition, BHP will suspend mining and processing activities at the Kwinana nickel refinery, Kalgoorlie nickel smelter and Mt Keith and Leinster operations, as well as pause development of the West Musgrave project.

The company will implement a care and maintenance program of work to ensure the ongoing safety and integrity of the mine and related infrastructure.

According to Prof Whittle, BHP would be losing over half a billion dollars per year if the company continues operating at full capacity.

“Continuing to operate at these prices is not an option and neither is closing, so what they [BHP] have chosen to do is pause the operation at a cost of $450m a year,” he said.

“In financial terms, you could view that as purchasing a financial option, which means they have the right, but not the obligation, to do something in the future, and in this case, that’s restarting operations.

“If they [BHP] didn’t spend this $450m a year, they wouldn’t have the option of restarting operations in the future – it would be too expensive.”

During this time, all nickel frontline employees will be offered another role within BHP or the choice of a redundancy.

BHP will also establish a $20m community fund to support local communities throughout the temporary suspension.

Additionally, BHP will continue to invest in exploration to extend the resource life of its WA nickel resources.

Developing new technologies

When refined and alloyed suitably, nickel plays a pivotal role in lithium-ion batteries, helping deliver a higher energy density and greater storage capacity.

Currently working on a way to recycle lithium-ion batteries, Dr Banerjee and Professor Sankar Bhattacharya from Monash University have come across a new type of green solvent that can separate nickel from other minerals.

“We can utilise this new green solvent for the separation of nickel from other minerals and this can be utilised in some of the mining systems where nickel is mixed with other metals and minerals,” Dr Banerjee said.

Dr Parama Banerjee.

A solvent is a substance that has the ability to dissolve other materials and form a solution.

Green solvents are deliberately formulated to achieve two primary objectives, reducing toxicity and conserving energy.

While Monash University is currently in the process of filing and publishing this process, further details cannot be released, however, Dr Banerjee says the particular solvent they are working with has been used in various applications.

“The materials that we are utilising to synthesise these solids are commercially available, they are low-cost materials and they’re not toxic,” she said.

“What sets them apart from other materials is that you can make thousands of permutations and combinations to make them suitable for targeted applications.

“We believe that this solvent might be useful for separating not only nickel but other materials such as cobalt, manganese and anything else that is present – we can take out what we need specifically.”

This new process from Monash University extracts the nickel through chemical leaching.

“Through chemical leaching, where this particular solvent reacts with nickel, an insoluble nickel salt is formed which can then be separated very easily,” Dr Banerjee said.

Future of the nickel industry

While this technology is still undergoing lab testing, Dr Banerjee hasn’t ruled out real-world testing in the future.

“At the moment we’re undertaking very small-scale lab testing to see whether these materials can extract the nickel efficiently but, given the opportunity, we would love to test this process with real mining material,” she said.

“We are trying to reach out to the mining industry and collaborate with them to see how we progress ahead.

“This process and particular solvent have the potential to be a game changer for Australian nickel miners who are currently using expensive and energy intensive methods to extract nickel.

“This can make the Australian industry a little bit more competitive worldwide.”