Proof in the pit

In WA’s North Perth Basin, Image Resources (ASX: IMR) is taking a calculated next step. The Atlas mineral sands project, now advancing towards first shipments, is a measured and deliberate extension of an established model.

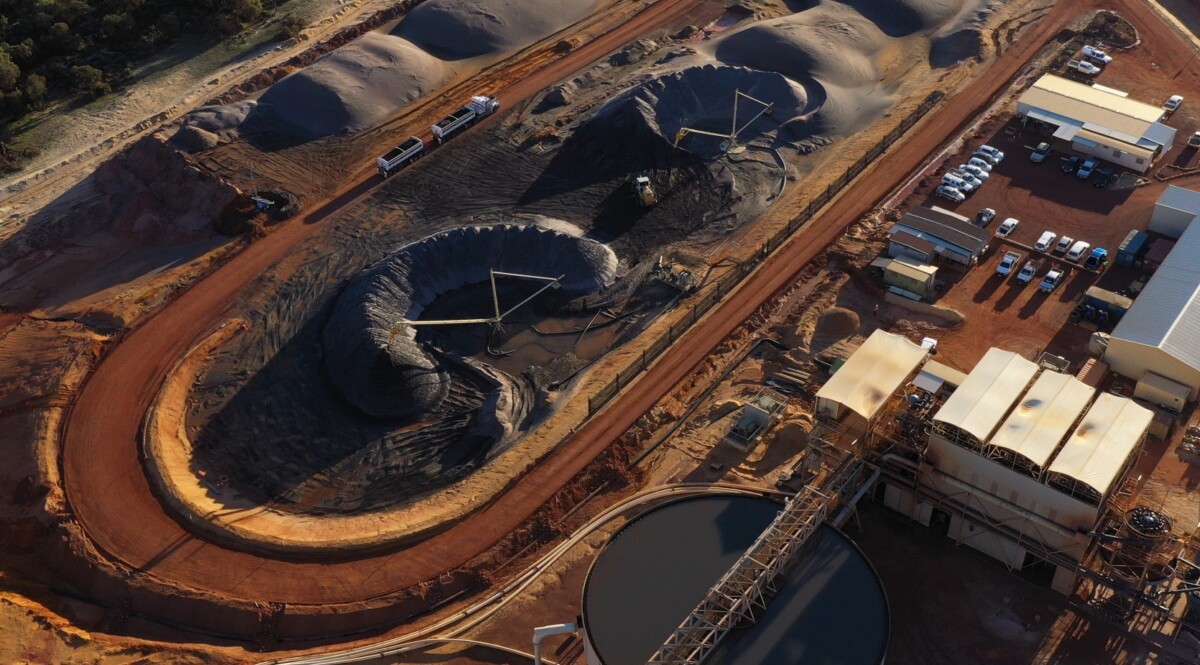

That model is Boonanarring — the zircon-rich operation located 80km north of Perth that set a new benchmark for Image. Commissioned in late 2018 and brought online within its $53m capital budget, the mine hit nameplate capacity by its second month and became cashflow positive within its first year.

By 2021, Image had not only repaid its $50m loan facility ahead of schedule but also returned value to shareholders with two consecutive years of dividends. The final ore at Boonanarring was mined in September 2023, with the last shipment of heavy mineral concentrate (HMC) dispatched just two months later.

What Boonanarring demonstrated was not only the strength of its resource base but the integrity of Image’s development model, built around dry mining, mobile plant flexibility and off-take stability.

170km to the north, Atlas is picking up where Boonanarring left off.

The Australian Mining Review speaks with Image Resources managing director and chief executive Patrick Mutz about this transition, the ramp-up at Atlas and how the company’s approach continues to shape its strategic direction.

Atlas kicked off in late 2024 and by March 2025, commissioning activities were in full swing. First HMC production remains on track for Q1 CY25, with initial shipment expected by the end of April. Backed by a $31.8m (USD $20m) prepayment facility secured in October and drawn down in January, Image has fully funded Atlas through to its first revenue in Q2 CY25.

Operational continuity and Atlas ramp-up

The development of the Atlas project has been notably lean. In its March 2025 operational update, Image confirmed that all major construction components — haul roads, solar-diesel hybrid power infrastructure and the relocation of the Boonanarring wet concentrate plant — were either completed or entering final commissioning.

No new processing plant had to be built from scratch. Instead, Image deconstructed, transported and reassembled key assets from Boonanarring, creating significant cost efficiencies and lowering execution risks.

Atlas is expected to produce between 170,000 to 190,000tpa of HMC over its initial two- to three-year mine life, with all product being shipped through Bunbury Port under existing offtake arrangements. These agreements, which were first negotiated during Boonanarring’s operating period, continue to provide Image with stable commercial pathways.

As Mr Mutz explains, this continuity has been central to the project’s strategy.

“This systematic approach proved to be successful at our Boonanarring project commissioning in 2019, allowing ramp-up to name plate capacity in only two months and we are confident it will lead to a rapid ramp up at Atlas,” he said.

Rather than rushing to full throughput, Image is implementing a staged increase in ore processing rates so that all systems, whether mechanical, electrical or hydraulic, are calibrated in real world conditions.

That approach paid dividends in 2019. Now, it’s doing so again in 2025.

Lessons from Boonanarring

One of the defining takeaways of Boonanarring isn’t found in its production figures or export metrics but the ground it left behind. Throughout its five-year life, the site became a testing ground for progressive rehabilitation strategies that not only met compliance obligations but helped set new internal benchmarks for Image Resources.

From the outset, Image adopted a policy which involved conducting backfilling and recontouring as mining operations advanced. This helped minimise environmental disruptions and shortened the timeframe between final mining and post-closure monitoring.

Nearly 50% of Boonanarring’s disturbed land was already undergoing recovery before the final tonne of ore was mined in September 2023. This was made possible by a sequencing strategy that prioritised near-surface backfill using in-pit tailings and waste placement.

Image also trialled reforestation efforts involving native species replanting, a method that provided insights into soil stability, groundwater response and biodiversity support.

In February 2024, Image confirmed that similar methods would be implemented at Atlas, with some refinements. These include improved water management designs and native seed banking based on learnings from Boonanarring’s post-mining flora studies. Atlas will also incorporate results from stakeholder engagement around land use expectations, a process piloted during Boonanarring’s later stages.

Repurposing to cut capital

Atlas is absorbing and applying the lessons of its predecessor on the fly. The redeployment of Boonanarring’s key equipment not only reduced capital expenditure and lead times but also ensured compatibility with Image’s internal operating models.

“Atlas is a shallow, high-grade deposit and was developed using proven equipment from our Boonanarring project,” Mr Mutz said.

“Consequently, capital costs were low and operating margins will be robust.”

Operational continuity has also been preserved through personnel. Several Boonanarring team members — including site engineers, environmental officers and HMC logistics coordinators — are now part of the Atlas workforce, ensuring that institutional knowledge remains intact. This has created a workforce culture that values trusted systems but remains adaptive to site-specific challenges, such as Atlas’s slightly deeper ore zones and differing water management needs.

The off-take and export pathways pioneered at Boonanarring remain fully intact. As of March 2025, HMC from Atlas will continue to be exported via the Port of Bunbury under existing agreements. This is a rare case where commercial arrangements, logistics networks and product quality controls have been directly inherited from a previous mine.

Navigating delays with operational discipline

If Boonanarring provided Image with technical confidence, Atlas has tested its ability to manage real-world disruption. The project encountered a number of setbacks during construction, including protracted environmental approvals and direct impact from bushfires in late 2024. Rather than derail the project timeline, these challenges became opportunities to demonstrate the company’s ability to respond in real time.

“Our ability to adapt quickly stems from an experienced management team with a proven track record, demonstrated through the successful delivery of the Boonanarring project which was constructed on time and on-budget and operated profitably and now with on-time and on-budget construction at Atlas,” Mr Mutz said.

In response to fire conditions in November 2024, Image reallocated internal resources, adjusted construction sequencing and maintained strong communication with contractors and regulators. These efforts allowed the company to complete the project on schedule, with commissioning commencing as planned in early 2025.

This approach also reinforced Image’s emphasis on internal coordination and contingency planning. These qualities are key to keeping capital delivery intact in uncertain operating environments.

“This same agility carries through into our operations,” Mr Mutz said.

“We are able to respond quickly to variable weather events or supply chain changes, due to our efficient and nimble internal coordination, decision making and contingency planning.”

A market-ready operation

With first revenue expected in Q2 CY25, Image is counting on a combination of low capital intensity and high-value mineral output to carry the project forward. By mid-March 2025, this process is well underway with the company transporting HMC from the Atlas site to storage facilities in Geraldton, aligning with their logistical strategy for timely shipments.

The ability to self-fund Atlas’s development from internal cash reserves has protected the company from debt exposure and volatile financing costs. Image did not require external capital raising to bring Atlas into production, a point of differentiation in a sector where new projects often depend on aggressive financing or joint ventures.

This cost structure is only one side of the equation. The quality of Atlas’s heavy mineral concentrate (HMC) plays an equal role in its medium-term outlook. Containing high-value zircon and high-grade ilmenite, Atlas’s coarse-grain concentrate caters to long-term offtake agreements across Asia’s pigment, ceramics and welding sectors.

“The outlook remains positive for high-quality HMC, particularly for coarser grain HMC such as at Atlas which contains high-value zircon and high-quality ilmenite, both of which continue to see strong demand from the ceramics, welding and pigment sectors,” Mr Mutz said.

“Like any commodity, market pricing can fluctuate in the short term, but structural supply constraints and growing demand across Asia and other key global markets are expected to support robust pricing over the medium term.”

Closing the loop

Investors, regulators and local communities are increasingly drawn to miners who can demonstrate not just one-off success but replicable performance under pressure. With Atlas’s first HMC shipment on track for Q2 CY25 and revenue soon to follow, the site stands as a validation of Image’s self-described “disciplined operator” status.

Looking ahead, Image remains open to regional consolidation and new development, with a strategic preference for projects that align with its demonstrated strengths.

“We have established a reputation as a low-cost project developer and a profitable operator,” Mr Mutz said.

“And we have a clear strategy for continued growth in the mineral sands industry.”

If Boonanarring was the concept and Atlas the proof, what comes next could be replication on an even broader scale — steady, measured and shaped by lessons already learned.