Liontown’s lithium liftoff

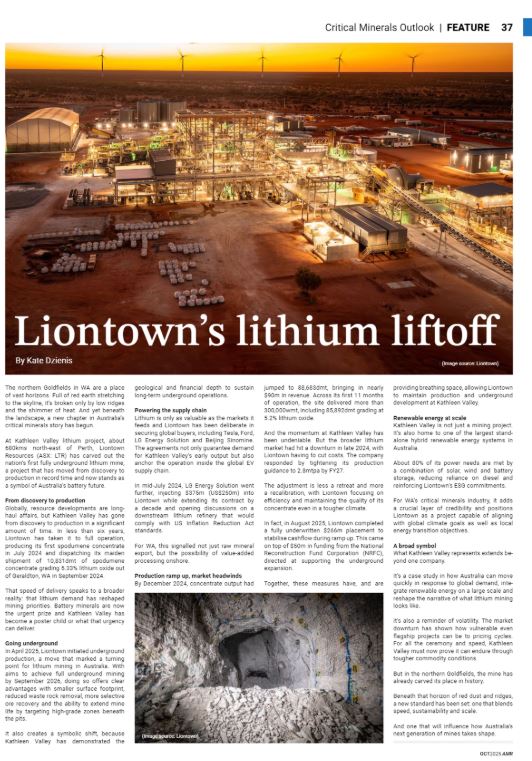

The northern Goldfields in WA are a place of vast horizons. Full of red earth stretching to the skyline, it’s broken only by low ridges and the shimmer of heat. And yet beneath the landscape, a new chapter in Australia’s critical minerals story has begun.

At Kathleen Valley lithium project, about 680kms north-east of Perth, Liontown Resources (ASX: LTR) has carved out the nation’s first fully underground lithium mine, a project that has moved from discovery to production in record time and now stands as a symbol of Australia’s battery future.

From discovery to production

Globally, resource developments are long-haul affairs, but Kathleen Valley has gone from discovery to production in a significant amount of time. In less than six years, Liontown has taken it to full operation, producing its first spodumene concentrate in July 2024 and dispatching its maiden shipment of 10,831dmt of spodumene concentrate grading 5.33% lithium oxide out of Geraldton, WA in September 2024.

That speed of delivery speaks to a broader reality: that lithium demand has reshaped mining priorities. Battery minerals are now the urgent prize and Kathleen Valley has become a poster child or what that urgency can deliver.

Going underground

In April 2025, Liontown initiated underground production, a move that marked a turning point for lithium mining in Australia. With aims to achieve full underground mining by September 2026, doing so offers clear advantages with smaller surface footprint, reduced waste rock removal, more selective ore recovery and the ability to extend mine life by targeting high-grade zones beneath the pits.

It also creates a symbolic shift, because Kathleen Valley has demonstrated the geological and financial depth to sustain long-term underground operations.

Powering the supply chain

Lithium is only as valuable as the markets it feeds and Liontown has been deliberate in securing global buyers, including Tesla, Ford, LG Energy Solution and Beijing Sinomine. The agreements not only guarantee demand for Kathleen Valley’s early output but also anchor the operation inside the global EV supply chain.

In mid-July 2024, LG Energy Solution went further, injecting $375m (US$250m) into Liontown while extending its contract by a decade and opening discussions on a downstream lithium refinery that would comply with US Inflation Reduction Act standards.

For WA, this signalled not just raw mineral export, but the possibility of value-added processing onshore.

Production ramp up, market headwinds

By December 2024, concentrate output had jumped to 88,683dmt, bringing in nearly $90m in revenue. Across its first 11 months of operation, the site delivered more than 300,000wmt, including 85,892dmt grading at 5.2% lithium oxide.

And the momentum at Kathleen Valley has been undeniable. But the broader lithium market had hit a downturn in late 2024, with Liontown having to cut costs. The company responded by tightening its production guidance to 2.8mtpa by FY27.

The adjustment is less a retreat and more a recalibration, with Liontown focusing on efficiency and maintaining the quality of its concentrate even in a tougher climate.

In fact, in August 2025, Liontown completed a fully underwritten $266m placement to stabilise cashflow during ramp up. This came on top of $50m in funding from the National Reconstruction Fund Corporation (NRFC), directed at supporting the underground expansion.

Together, these measures have, and are providing breathing space, allowing Liontown to maintain production and underground development at Kathleen Valley.

Renewable energy at scale

Kathleen Valley is not just a mining project. It’s also home to one of the largest standalone hybrid renewable energy systems in Australia.

About 80% of its power needs are met by a combination of solar, wind and battery storage, reducing reliance on diesel and reinforcing Liontown’s ESG commitments.

For WA’s critical minerals industry, it adds a crucial layer of credibility and positions Liontown as a project capable of aligning with global climate goals as well as local energy transition objectives.

A broad symbol

What Kathleen Valley represents extends beyond one company.

It’s a case study in how Australia can move quickly in response to global demand, integrate renewable energy on a large scale and reshape the narrative of what lithium mining looks like.

It’s also a reminder of volatility. The market downturn has shown how vulnerable even flagship projects can be to pricing cycles. For all the ceremony and speed, Kathleen Valley must now prove it can endure through tougher commodity conditions.

But in the northern Goldfields, the mine has already carved its place in history.

Beneath that horizon of red dust and ridges, a new standard has been set: one that blends speed, sustainability and scale.

And one that will influence how Australia’s next generation of mines takes shape.