FIRB approves Westgold-Karora merger

The Foreign Investment Review Board (FIRB) has issued its approval of Westgold’s (ASX: WGX) acquisition of Karora.

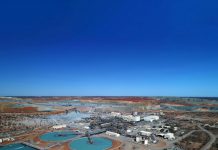

The enlarged Westgold will have a $2.4b market cap with combined ore reserves of 3.2moz and mineral resources of 13moz, which Westgold says will place it solidly among the top 5 ASX-listed gold producers operating predominantly in Australia.

The company will be well funded, with financial resources of about $160m and dual listing on the ASX and Toronto stock exchange (TSX).

Westgold expects to complete the transaction by the end of July, pending approval by Karora shareholders at its July 19 meeting.

Westgold managing director and chief executive Wayne Bramwell says the value proposition created by the merger is compelling.

“With their vote for the transaction, Karora shareholders will create a larger internationally investible gold company that is unhedged, well-funded and fully leveraged to the gold price,” he said.

“The new Westgold will have strategic footprints across two of WA’s most prolific goldfields and have an enhanced team and platform to continue to deliver returns to its shareholders.

“Westgold is working closely with Karora management in preparation for integration and looks forward to formally welcoming the Karora team to the expanded company at month end.”

The acquisition is unanimously recommended by the Karora board with all Karora directors and senior officers forming agreements with Westgold to vote in favour of the transaction.