Minerals booming in latest Australian resource forecasts

The Federal Industry, Science and Resources Department has reported growing resources and energy export volumes in the most recent Australian Resources and Energy Quarterly (REQ).

Gold is set to become Australia’s third largest resources export earner, as the commodity fetches record prices, behind iron ore and liquid natural gas next year, with earnings forecast to reach $56b, according to the REQ. Exploration expenditure for iron ore — Australia’s largest export earner — continues to rise.

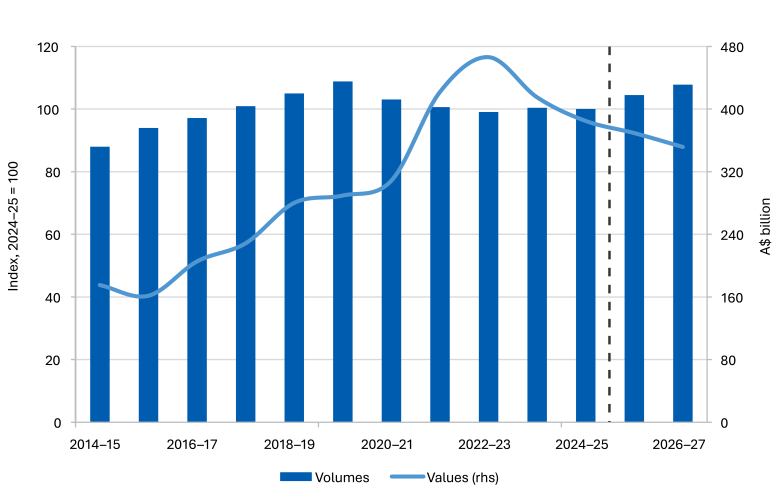

Amid continued fallout over global trade tensions and conflicts — the REQ reported — Australia will see export numbers retreat from historical highs as commodity prices are influenced. Published by the Department of Industry, Science and Resources, the REQ forecasts export earning to decline from $385b in FY25 to $369b in FY26 and further fall to $352b in FY27.

Federal Resources Minister Madeleine King says despite the lower revenue, export volumes are forecast to increase marginally over the next two years and continue to support jobs and Australia’s economy.

“The latest REQ underlines how Australia remains a trusted and reliable supplier of resources and energy to the world at a time of ongoing global uncertainty,” she said.

“While global commodity prices are easing, the report suggests Australian resources companies will continue to remain competitive on the global stage.

“Higher prices for gold, and forecast higher copper and lithium exports, are partly offsetting the impact of lower prices for iron ore, coal and liquid natural gas (LNG).”

The forecasts of the June 2025 REQ are moderately lower than those contained in the March 2025 REQ and reflects the rising trade barriers that continue to emerge globally.

World economic growth remains relatively soft, as reported by the REQ, amidst the disrupted trade between the US and its major partners which has resulted in increased caution and has induced weak economic activity.

The latest Ernst & Young (EY) Royalty and Company Tax Payments report, commissioned by the Minerals Council of Australia, shows the minerals industry remains the nation’s leading export earner.

The report shows that over the past decade, the Australian minerals sector has contributed $394.6b to government revenues, comprising $227.5b in company tax and $167.1b in royalties.

In FY24, the industry paid $59.4b in tax and royalties payments to federal, state and territory governments which included $32.5b in company tax and $26.9b in royalties.

Minerals Council of Australia chief executive Tania Constable says a strong mining industry means a stronger Australia.

“While commodity markets have normalised following recent highs, tax and royalty payments remain far above historical norms,” she said.

“The ongoing strength of the sector’s contribution — even as cost pressures mount — underscores the need for a sharp focus on lifting productivity across the economy.”

According to the Reserve Bank of Australia, mining is the second highest key contributor to the national economy, contributing 12.2% as of May 2025.

“If Australia wants to safeguard the jobs, investment and revenue generated by mining, governments must support a more productive and competitive operating environment,” Ms Constable said.

“The minerals industry remains the country’s leading export earner, a major employer in regional Australia, and a vital source of the government revenue that funds Australia’s most important services and ambitions.”