Greatland gears up for ASX

Greatland is closing in on cross-listing on the ASX and London Stock Exchange after submitting a prospectus to both the Australian Securities & Investments Commission (ASIC) and the ASX.

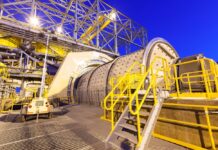

Simultaneously, the company is making strides in its operations, as evidenced by the recently unveiled two-year outlook for its Telfer gold-copper mine, located in the Paterson Province of the East Pilbara region of WA. This projection extends dual-train production through to FY27, creating a bridge to Havieron production. The integrated output from Havieron and Telfer is slated to begin during FY28, a step that could reduce costs and maintain production volumes at elevated levels.

Greatland’s ambitions don’t end there. The announcement of the initial Telfer ore reserve, expected to yield a promising 712koz gold and 23kt copper, indicates significant potential for growth in their Australian operations.

Also under works is the Havieron feasibility study to investigate potential mining rate expansion. Currently at 2.8mtpa, Greatland is considering an increase to anywhere between 4-4.5mtpa — an increase of 43%-60%. This possible production surge supports the miner’s commitment to enhancing its operations and maximising productivity.

The envisioned expansion isn’t just about amplifying production figures — it’s equally focused on sustaining that success. The initiation of integrated Havieron and Telfer production during FY28 could result in sustained high-volume production and significant cost reductions. This, coupled with a favourable gold price environment, could translate into a healthy cash flow for Greatland Gold.

With a readiness to capitalise on opportunities and a commitment to maintaining smooth operational flow in a record-breaking price environment, there’s little doubt that Greatland Gold will remain in the spotlight. Investors are sure to watch closely as the company navigates this critical phase of growth and expansion.

Greatland managing director and chief executive Shaun Day speaks with the Australian Mining Review to provide insight on the miner’s plans.

AMR: it’s clear the recent Telfer two-year outlook gives us a pretty good glimpse into the future of Greatland’s operations. Could you delve a bit deeper into the factors that have led to such an optimistic forecast?

SD: When we acquired the asset, it came with a 15 month mine life. Our focus was to add to that mine life, because otherwise we were depleting it through operations.

We had a really successful March quarter. In those 15 weeks, we were able to add 154mt, encompassing 3.2moz of additional gold and117,000t of copper. We felt we identified a lot of that material through the due diligence process, which allowed us to accelerate that JORC process, but it was a real focus on us to add mine life.

At Northern Star (ASX: NST), we acquired six assets off global majors and four of those had a mine life of less than 12 months. All six of those assets are still operating a decade later. That’s the same opportunity we have at Telfer, plus we have a tremendous asset coming online in 2028.

AMR: You were able to extend that pre-acquisition mine plan by 18 months. What were the enabling factors for that move?

SD: We tripled the numbers of rigs at site, so this built off some of the existing drilling. We were very focused on investing in the drill rig and investing in the resource geology team to make sure that we could move quickly and efficiently to add mine life.

AMR: We are keen to hear more about the expected impact of Havieron production, due to kick off during FY28. How will this affect the overall operational efficiency and cost-effectiveness at Greatland?

SD: The reason we want to extend that mine life for two years across FY26 and FY27 is to demonstrate the Telfer life extension to when Havieron comes online. When Havieron comes online it will be quite transformational because there is a higher grade, lower cost production coming into that same processing plant. Because Havieron is a brownfield extension of the existing Telfer infrastructure, it just brings this very high-grade, low-cost feed into the existing Telfer operation. It makes Telfer better.

AMR: I understand there’s a feasibility study looking at ramping up the mining rate at Havieron from 2.8mtpa to potentially 4.5mtpa. Can you tell us more about the development of the underground crusher and material handling system to support this?

SD: Our intent is to get that study out towards the end of CY25. That bulk handling system we see as being a conveyor. It’s good ESG, even better economics.

With such a long-life, high-grade asset, we can afford to invest in the infrastructure upfront to set this asset up for success over multiple decades.

AMR: Given Greatland’s healthy balance sheet and the continuation of Telfer production in a rather buoyant gold price environment, what financial strategies are you considering to guarantee sustainable growth for Greatland Gold in the coming years?

SD: We’ve taken an approach of deliberately prioritising balance sheet strength. At the end of the March quarter, we’ve grown to have $398m in the bank debt-free. That’s an exceptional position to be in just four months into production. That balance sheet strength should give the market confidence that we have the ability to invest in the asset, to continue to optimise and increase the mine life at Telfer and successfully deliver Havieron.

We also have the support of ANZ, ING and HSBC. We’re very grateful for the support of these tier one banks. They’ve also put in place a $750m seven-year project facility for Havieron which is subject to finalisation of the feasibility study.

We feel that gives us a very clear pathway to both leverage the balance sheet strength we have, plus the ongoing potential for free cash flow generation, of Telfer which gives the market a lot of confidence that we are well placed to deliver Telfer and Havieron.

A big part of what we’ve done is to put together a team that has the right experience to optimize Telfer-Havieron and we’re really looking forward to listing on the ASX in late June. That’s going to be a significant milestone for the company.