Australia’s future, fuelled by phosphate

Australia’s largest holder of phosphate resources, North West Phosphate (NWP), is in the business of feeding Australia. The miner, which now holds the last remaining domestic fertiliser mine, is set to deliver critical high-quality phosphate rock and strengthen fertiliser production across Australia and Southeast Asia.

Global phosphate markets, and thus our food security outlook, are facing mounting challenges in the form of global uncertainty and increasing demand.

NWP managing director and executive chairman John Cotter speaks with the Australian Mining Review on the company’s role in ensuring the resilience of Australia’s agricultural supply chains while injecting valuable economic benefits into the heart of northwest Queensland even in turbulent times.

When it comes to mining, many of our concerns are centred around energy demand issues, with the importance of food security taking a back seat. The issue of food security is increasingly relevant due to increased consumption demand compounded by a rocky global trading environment.

A country that can feed itself is less vulnerable to global shocks, wars or trade disruptions. If Australia relies too heavily on imported food, it risks being exposed during future crises.

A key to self-reliance? Stable phosphate production.

Phosphorus is an essential building block for all life on earth as a vital nutrient for humans, animals and plants. Although the mineral is naturally occurring in various forms, to sustain modern agricultural production, it needs to be added as a component in fertiliser and feed supplements.

This is where mining enters the picture. The global fertiliser market currently consumes a whopping 200mtpa of rock phosphate. This number is only set to rise, as demand for fertilisers is determined by the outlook for agricultural production, which is intrinsically linked to food consumption and the need for animal feed, natural fibres and biofuels. This fertilizer demand is forecast to increase from 197mt of nitrogen, phosphorous pentoxide and potassium oxide in 2020 to 275mt in 2045.

“Australia imports most of its finished products — more than 90% of phosphate rock that goes into production,” Mr Cotter said.

“Because of this, we are very exposed to global shocks and supply chain risk.

“When global shipping slows or a geopolitical event unfolds every seven to eleven years, this results in a fertiliser crisis in Australia.”

The decline in domestic fertiliser production and processing capability in Australia has significant implications for the future productivity and security of agricultural production. Genuine sovereign capability questions should be asked about Australia’s capacity to grow agricultural products on a commercial scale if our current supply chains are interrupted. NWP is setting itself up to be the answer to these questions.

Paradise found

Despite Mount Isa mines generating economic value of national significance for decades, there is now an urgent effort to progress projects to compensate for the direct and indirect economic and social impacts to the community.

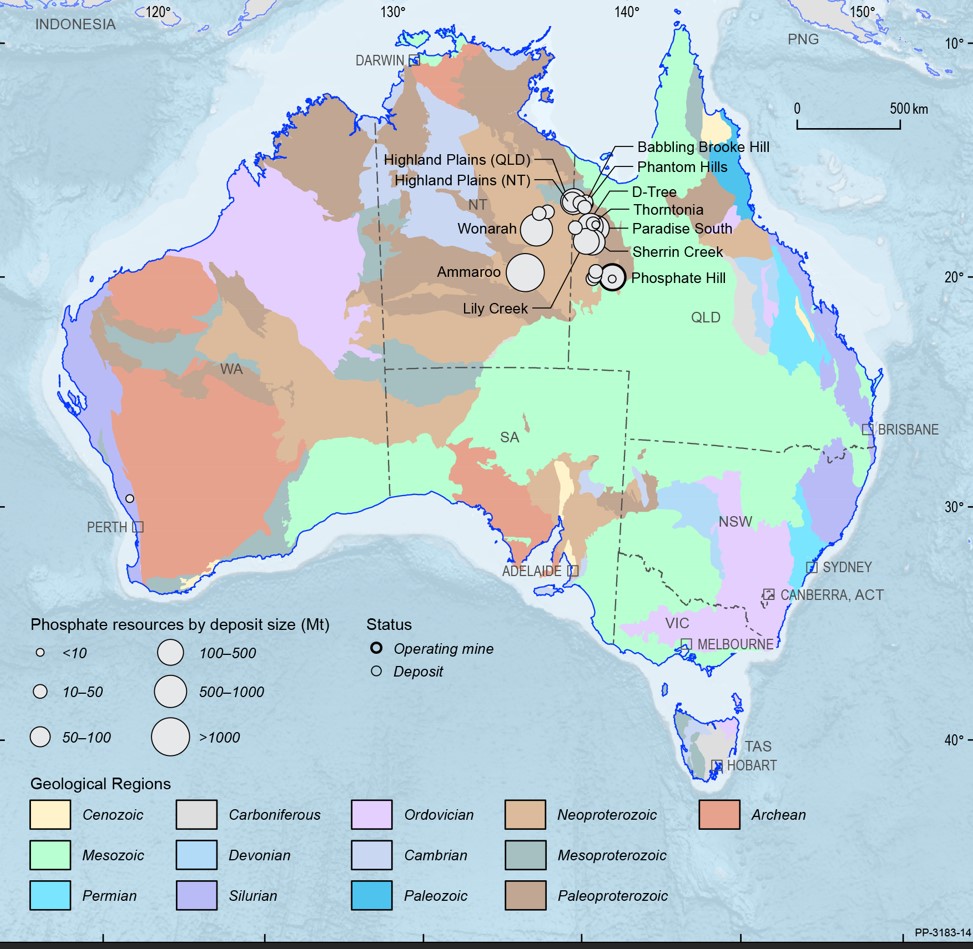

NWP owns four phosphate projects northwest of Mount Isa spanning 65ha. Its flagship Paradise South mine is now breaking from the pack, as the mine is fast approaching project commissioning.

With the recent restructuring of Incitec Pivot’s Phosphate Hill operation, Centrex’s Ardmore phosphate operation entering voluntary administration and the imminent closure of Glencore’s Lady Loretta mine and copper smelter, NWP’s Paradise South project fills a critical gap in the market, delivering economic certainty and a much-needed jobs boost in the region.

According to North West Phosphate, the Paradise South project is expected to create hundreds of jobs during construction and operation and inject tens of millions of dollars into both the local economic and the state of Queensland over its lifetime.

“In the mining context, we have a unique position in that we have the largest resource in the country and we’re the last domestic fertilizer rock miner,” Mr Cotter said.

“We feel that there is a national sovereign risk issue that must be addressed.

“We would like to see more junior miners come on board, but these miners need scale and size.”

Paradise South is well positioned, with NWP looking to make the most of its existing scale and size.

“Our plan is to partner with Sibanye Stillwater at the Century zinc mine and build our flotation plant there, allowing us to export through the slurry line and the port of Karumba,” Mr Cotter said.

“This dramatically reduces the cost and the long-term logistics risk of the rail line to Townsville and the port of Townsville.

“This represents a quarter of the cost base compared to the other path to market.

“The untimely collapse of Centrex proved that our thinking was sound earlier this year.”

With a mine life projected to exceed 50 years and a production target of 1mtpa of high-grade phosphate rock, the project aims to support agricultural growth, secure food supply and lower living costs for millions of consumers.

NWP is also conducting a project study exploring the possibility of combining the phosphate resources at its Paradise South mine with the existing infrastructure at the Century Mine. This connects processing facilities, slurry pipeline and the Port of Karumba, ensuring a streamlined and cost-effective development pathway. The study is on track to be completed by the end of 2025.

The challenges continue

In addition to the global supply chain complexities for phosphate, cost, energy and logistics all remain a prominent challenge for NWP.

Energy supply to all industries in northern Australia is driving materials overseas and impacting domestic manufacturing. According to NWP, power prices in Mount Isa are notably higher than in other parts of Queensland, primarily due to its isolated energy network and reliance on local gas-fired generation.

“No matter how you cut it, diesel generators still win the day,” Mr Cotter said.

“We are all trying to do the right thing and decrease our carbon footprint, but we can only do that when it’s reliable supply… it has to be an energy mix.

“We’re just simple miners. We want the cheapest supply of an import that we possibly can get to help us ride out supply shocks.

“We’re in an industry that goes crisis-to-crisis and is interrupted by one or two periods of significant revenue, so we must be Q1 cost-focused all the time.”

Despite the challenges, NWP isn’t backing down. Mr Cotter offers this advice to fellow miners.

“We raised more than $350m last year on an asset that’s not a sexy commodity,” he said.

“My message to the mining community is we’re coming back. Everyone is coming back.

“Private equity is coming in, so get out there and beat the pavement — get to UAE, get to London, get to the US, because the money is there if you’re willing to chase it.

“My call to arms is for the Australian investor market to go beyond exploration risk.

“Let’s start funding producers and near-term producers, because the rest of the world’s capital is coming, and we should share in that.”