All images: Boss Resources.

BY ELIZABETH FABRI

BOSS Resources is the proud owner of the Honeymoon project, one of the few Australian uranium projects ready to participate in the early stages of a new bull market. We spoke with Boss Resources managing director and chief executive Duncan Craib about the mine’s restart plan, technologies chosen for processing, and his outlook for the uranium market in the near-term.

Q. Take us through the re-start strategy for Honeymoon.

In July 2018 the company launched the re-start strategy for the Honeymoon uranium project in South Australia, as categorised into three key phases;

Phase 1: The generation of the final input data required for the DFS including the drilling program to deliver the measured and indicated resource, an optimisation program to deliver further cost savings and/or process improvements and a preliminary execution plan, updated cost estimate and schedule for the re-start of the existing solvent extraction (“SX”) plant.

Phase 2: The second phase comprises the DFS and permitting updates.

Phase 3: The third phase covers the detailed execution planning, operational readiness inclusive of the SX plant recommissioning plan, in conjunction with the ion exchange plant detailed design.

Phase 1 is ahead of schedule with the infill drilling campaign our current primary focus, targeting an area of resource located on the existing Mining Licence within close proximity and within well-field pumping distance to the existing processing plant infrastructure. No further permitting is required to extract resources within this area and accordingly, the initial wellfield operations will be conducted in this area to supply production during the early years of operation.

Over 100 holes have been drilled to date with the initial reported drill results of 50 mud rotary drill holes returning exceptional results (as announced to ASX on 2 August 2018) surpassing our expectations in both grade and thickness of the mineralisation. Hole BIF0044’s quality drill result was quite exceptional at 9.5m width at 7,407ppm pU3O8 (70,367 GT), ranking it as one of the best intersections drilled at Honeymoon.

To put it into perspective, our cut-off grade is 250ppm and whilst we could mine at lower grades, there are numerous cost and operational benefits to leaching higher grade material from continuous thicknesses. Primarily, less ore has to be leached to extract the same amount of contained uranium, which typically results in lower operating costs and increased operating margins.

Q. When do you hope to hit the start button on production, assuming the uranium market is favourable?

The Honeymoon mine can respond very quickly to changing market conditions and catch the upside of the market cycle. The existing SX plant is currently on care and maintenance and can reach a production level of around 880,000lbs per year within a nine month period and, with the addition of the IX plant, ramp up to 2mlbs per year within 24 months.

In general, deliveries under long term contracts commence around 18 months to two years after the contracts are signed, this would allow Boss the advantage of signing term agreements for supply in parallel with taking the decision to move forward with production. This is a rare advantage for a new producer as in many instances production may start several years after the decision to produce is taken and market conditions may have changed significantly.

Sustainable long-term prices above US$40 – $45/lb would be a trigger to draw the Board’s attention to a decision to start production.

Q. Take us through your decision to incorporate a $US58m ion exchange circuit into the processing plant? Were there any other processing technologies considered?

Like Honeymoon, more than 50 per cent of the world’s uranium is mined by in situ leach methods, also known as in situ recovery (ISR), which is seen as the most cost effective and environmentally acceptable method of mining, and other experience supports this. Once the pregnant leached solution is pumped from the ISR production wells to the treatment plant the uranium can with be recovered by a resin/polymer ion exchange (IX) or by an liquid ion exchange (solvent extraction – SX) system. The IX system however is the preferred processing option, accounting for the vast majority of ISR operations due to its comparably low operating and capital costs.

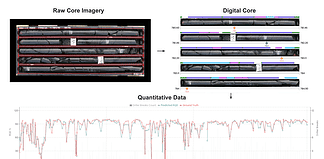

Boss Resources’ company-making identification of an optimal resin to support IX production for Honeymoon followed extensive laboratory test work in 2017 with ANSTO. To provide further technical validation the company conducted a highly successful Field Leach Trial in July to November 2018 (as announced to ASX on 26 October 2017 and 1 November 2017), during which the modified leaching regime produced significantly higher uranium tenors than had previously been achieved at Honeymoon. The IX pilot plant also performed exceptionally well, delivering the key technical validation step on recovering uranium efficiently from real leach liquor.

The outstanding Field Leach Trial results justifies the decision to pursue Ion Exchange and its significant potential for economic upside being the most efficient, lowest risk and lowest cost method of processing uranium.

Another key advantage of the IX process is that it can be utilised on isolated orebodies where a satellite plant can be set up if the central process plant is too distant. Essentially a facility is established to load the ion exchange resin/polymer so that it can be trucked to the central Honeymoon plant for further processing. Hence isolated orebodies can become viable, since apart from the wellfield, little capital expenditure is required at the mine site.

Q. How close are you to securing offtake agreements, have you fielded many sales enquiries to date?

The market is still a buyer’s market though there are positive signs of upward price movement in the spot and term markets. Boss has been responsive to buyers’ requests for proposals for supply and had been in informal discussions with potential off-takers. We have a clear price objective in mind and while it is higher than current market expectations we are well within the range of expected near term price movements. We are unable to disclose any details as any discussion are confidential.

Q. If the US decides to introduce tariffs on uranium imports, how (or will) will this impact Honeymoon?

At this stage it is too early to know what form, if any, restriction on imports to the US will take. Australia has been a long-standing, reliable and responsible uranium supplier to the US and in 2017, US nuclear utilities purchased almost one-fifth of their requirements from Australia. The focus of concern for the US petitioners appears to be on supply from state-owned companies which is not an issue for supply from Australia. We will continue to monitor these developments closely. The US is a very important market for us but one shouldn’t forget that just under two thirds of world demand is outside the USA.

Q. What is your outlook for the uranium market Are you confident prices will improve?

Yes, we are confident that price will improve and it is increasing having reached $US27/lb. Demand is growing especially in China, India and Russia, we are seeing emerging nuclear nations such as Saudi Arabia and more reactors restarting in Japan. Even prior to the recent cutback in uranium production in Canada, Kazakhstan and Africa due to unsustainably low prices, industry forecasts showed a need for new uranium production in the early to mid-2020s; cutback to production have brought that deadline forward. To bring existing production back on line and encourage development of new production in time to meet demand prices will have to rise significantly several years prior to when production is needed. We are already seeing signs that the market is tightening. For many of the new mines a sustainable price would be in the $US50 to 70/lb range.

Q. Final thoughts?

Since Boss Resources’ acquisition of Honeymoon in December 2015, we have progressively de-risked the project both technically and commercially to the point where on completion of the re-start strategy, we will be ready to execute the programs of work required to restart Honeymoon assuming a specified uranium price has been achieved to satisfy the targeted IRR and NPV return to maximise shareholder value.

The project is fully permitted with a 3.3mlbs pa export licence and existing plant an infrastructure invested at over A$170m. Honeymoon can be brought back into production in a mere 12 months, and being an ISR mine in combination with IX production, would rank as one of the lowest cost producers world-wide. Furthermore, there is significant exploration upside with a target of between 32Mt to 78Mt at a grade of between 450ppm and 1400ppm U3O8 with a potential target endowment of between 42Mlb and 100Mlb of contained U3O8.