Critical minerals catch fire

There’s a scattered pool of resources across the globe that our carefully laid future plans rely on. Without critical minerals, the technologies that enable the promises of a clean, secure and efficient future are not possible.

The energy transition is accelerating, quickly becoming a significant driver of mineral demand. If countries fully implement the national energy and climate pledges they have announced, mineral demand for clean energy technologies would more than double by 2030 and triple by 2040, reaching nearly 35mtpa, according to the IEA.

Despite outlooks of a fired-up future demand, critical mineral supply chains are still vulnerable to disruption.

While the potential for disruption of any commodity is ever present, the risk is heightened when production and processing are concentrated in a few countries, facilities or companies, like those of many of our critical minerals. It isn’t just a luck of the draw — there is real opportunity to stabilise global supply chains across minerals and the value chain through directed domestic investment.

In the first instalment of our Critical Minerals Prospectus series, the Australian Mining Review looks at the trailblazing critical minerals projects keeping our energy transition dreams from going up in smoke.

Australia’s unrealised resources

Australia can take charge of its own destiny, through investment in exploration, extraction and development of projects further up the value chain that elevate existing resources across our 31 critical minerals.

Up to 80% of our continent remains underexplored, meaning there is still significant potential to discover new deposits, especially when it comes to resources that have previously unrealised applications.

While Australia has world-leading scientific expertise, particularly when it comes to exploration, and a track record as a reliable producer and exporter, expertise still needs to be built across the entire value chain to actualise the benefits of our geological endowment and take us through the energy transition.

While talk about critical minerals, and their role in future technologies is always growing, the realities of how we get there and what our resources industry looks like after these goals are met is sometimes lost in the rush of future-focused conversation.

A clear and actionable path forward lies in supporting a healthy and active pipeline of new projects to market, only made possible by investment and collaboration from governments, communities and industry.

In the Federal Government’s Critical Minerals Strategy 2023-2030, a vision for the near future is outlined. By 2030, Australia will have grown the geostrategic and economic footprint of our critical minerals sector by becoming a globally significant producer of raw and processed critical minerals, the strategy envisions.

The critical minerals market is still expected to grow between two and fourfold by 2030, according to the Australian Trade and Investment (Austrade). To take part in this growth, the strategy outlines six focus areas for Australia: developing strategically important projects, attracting investment and building international partnerships, First Nations engagement and benefit sharing, promoting Australia as a world leader in ESG performance, unlocking investment in enabling infrastructure and services and growing a skilled workforce.

What projects take Australia to the other side?

Critical call for investment

Austrade’s Australian Critical Minerals Prospectus addresses these focus areas — outlining more than 55 investment-ready projects in an interactive map, facilitating offtake and investment.

The online tool is customisable, allowing users to navigate Australia’s mineral endowment with a vision of attracting investment that can catalyse the Critical Minerals Strategy.

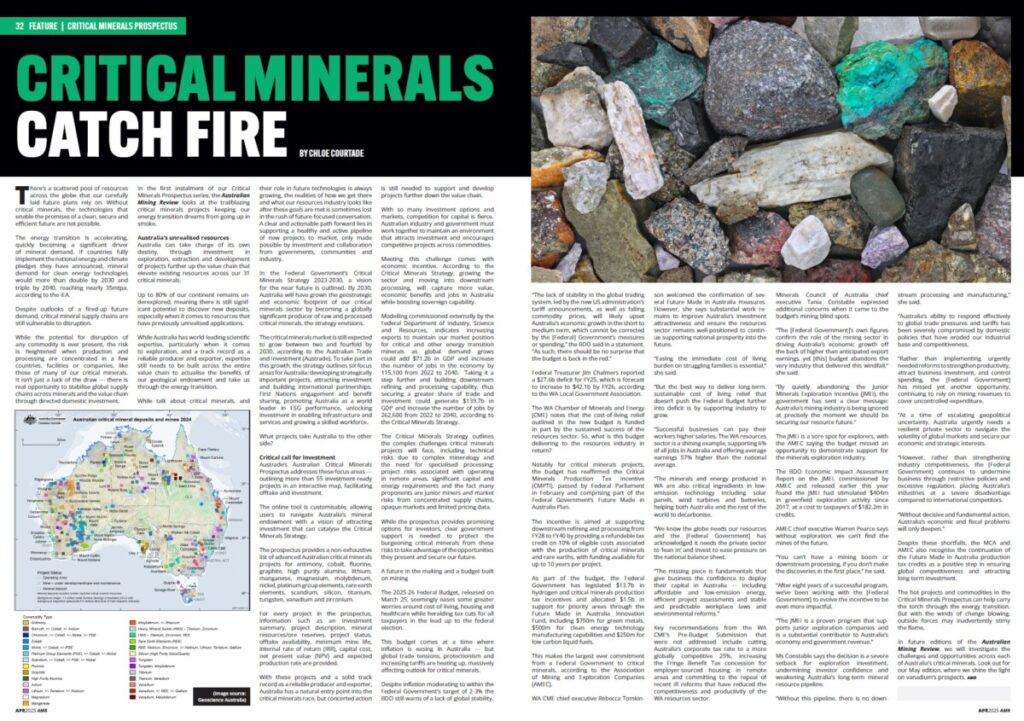

The prospectus provides a non-exhaustive list of advanced Australian critical minerals projects for antimony, cobalt, fluorine, graphite, high purity alumina, lithium, manganese, magnesium, molybdenum, nickel, platinum group elements, rare earth elements, scandium, silicon, titanium, tungsten, vanadium and zirconium.

For every project in the prospectus, information such as an investment summary, project description, mineral resources/ore reserves, project status, offtake availability, minimum mine life, internal rate of return (IRR), capital cost, net present value (NPV) and expected production rate are provided.

With these projects and a solid track record as a reliable producer and exporter, Australia has a natural entry point into the critical minerals race, but concerted action is still needed to support and develop projects further down the value chain.

With so many investment options and markets, competition for capital is fierce. Australian industry and government must work together to maintain an environment that attracts investment and encourages competitive projects across commodities.

Meeting this challenge comes with economic incentive. According to the Critical Minerals Strategy, growing the sector and moving into downstream processing, will capture more value, economic benefits and jobs in Australia while boosting sovereign capability.

Modelling commissioned externally by the Federal Department of Industry, Science and Resources, indicates increasing exports to maintain our market position for critical and other energy transition minerals as global demand grows could add $71.2b in GDP and increase the number of jobs in the economy by 115,100 from 2022 to 2040. Taking it a step further and building downstream refining and processing capability, thus securing a greater share of trade and investment could generate $139.7b in GDP and increase the number of jobs by 262,600 from 2022 to 2040, according to the Critical Minerals Strategy.

The Critical Minerals Strategy outlines the complex challenges critical minerals projects will face, including technical risks due to complex mineralogy and the need for specialised processing; project risks associated with operating in remote areas, significant capital and energy requirements and the fact many proponents are junior miners and market risks from concentrated supply chains, opaque markets and limited pricing data.

While the prospectus provides promising options for investors, clear government support is needed to protect the burgeoning critical minerals from these risks to take advantage of the opportunities they present and secure our future.

A future in the making and a budget built on mining

The 2025-26 Federal Budget, released on March 25, seemingly eases some greater worries around cost-of-living, housing and healthcare while heralding tax cuts for all taxpayers in the lead up to the federal election.

This budget comes at a time where inflation is easing in Australia — but global trade tensions, protectionism and increasing tariffs are heating up, massively affecting outlook for critical minerals.

Despite inflation moderating to within the Federal Government’s target of 2-3% the BDO still warns of a lack of global stability.

“The lack of stability in the global trading system, led by the new US administration’s tariff announcements, as well as falling commodity prices, will likely upset Australia’s economic growth in the short to medium term, which cannot be corrected by the [Federal] Government’s measures or spending,” the BDO said in a statement.

“As such, there should be no surprise that the budget is back in the red.”

Federal Treasurer Jim Chalmers reported a $27.6b deficit for FY25, which is forecast to increase to $42.1b by FY26, according to the WA Local Government Association.

The WA Chamber of Minerals and Energy (CME) notes that the cost-of-living relief outlined in the new budget is funded in part by the sustained success of the resources sector. So, what is this budget delivering to the resources industry in return?

Notably for critical minerals projects, the budget has reaffirmed the Critical Minerals Production Tax Incentive (CMPTI), passed by Federal Parliament in February and comprising part of the Federal Government’s Future Made in Australia Plan.

The incentive is aimed at supporting downstream refining and processing from FY28 to FY40 by providing a refundable tax credit on 10% of eligible costs associated with the production of critical minerals and rare earths, with funding available for up to 10 years per project.

As part of the budget, the Federal Government has legislated $13.7b in hydrogen and critical minerals production tax incentives and allocated $1.5b in support for priority areas through the Future Made in Australia Innovation Fund, including $750m for green metals, $500m for clean energy technology manufacturing capabilities and $250m for low carbon liquid fuels.

This makes the largest ever commitment from a Federal Government to critical minerals, according to the Association of Mining and Exploration Companies (AMEC).

WA CME chief executive Rebecca Tomkinson welcomed the confirmation of several Future Made in Australia measures. However, she says substantial work remains to improve Australia’s investment attractiveness and ensure the resources sector remains well-positioned to continue supporting national prosperity into the future.

“Easing the immediate cost of living burden on struggling families is essential,” she said.

“But the best way to deliver long-term, sustainable cost of living relief that doesn’t push the Federal Budget further into deficit is by supporting industry to grow.

“Successful businesses can pay their workers higher salaries. The WA resources sector is a shining example, supporting 6% of all jobs in Australia and offering average earnings 57% higher than the national average.

“The minerals and energy produced in WA are also critical ingredients in low-emission technology including solar panels, wind turbines and batteries, helping both Australia and the rest of the world to decarbonise.

“We know the globe needs our resources and the Federal Government has acknowledged it needs the private sector to ‘lean in’ and invest to ease pressure on the national balance sheet.

“The missing piece is fundamentals that give business the confidence to deploy their capital in Australia — including affordable and low-emission energy, efficient project assessments and stable and predictable workplace laws and environmental reforms.”

Key recommendations from the WA CME’s Pre-Budget Submission that were not addressed include cutting Australia’s corporate tax rate to a more globally competitive 25%, increasing the Fringe Benefit Tax concession for employer-sourced housing in remote areas and committing to the repeal of recent IR reforms that have reduced the competitiveness and productivity of the WA resources sector.

Minerals Council of Australia chief executive Tania Constable expressed additional concerns when it came to the budget’s mining blind spots.

“The [Federal Government]’s own figures confirm the role of the mining sector in driving Australia’s economic growth off the back of higher than anticipated export earnings, yet [this] budget abandons the very industry that delivered this windfall,” she said.

“By quietly abandoning the Junior Minerals Exploration Incentive (JMEI), the government has sent a clear message: Australia’s mining industry is being ignored at precisely the moment we should be securing our resource future.”

The JMEI is a sore spot for explorers, with the AMEC saying the budget missed an opportunity to demonstrate support for the minerals exploration industry.

The BDO Economic Impact Assessment Report on the JMEI, commissioned by AMEC and released earlier this year found the JMEI had stimulated $404m in greenfield exploration activity since 2017, at a cost to taxpayers of $182.2m in credits.

AMEC chief executive Warren Pearce says without exploration, we can’t find the mines of the future.

“You can’t have a mining boom or downstream processing, if you don’t make the discoveries in the first place,” he said.

“After eight years of a successful program, we’ve been working with the [Federal Government] to evolve the incentive to be even more impactful.

“The JMEI is a proven program that supports junior exploration companies and is a substantial contributor to Australia’s economy and government revenue.”

Ms Constable says the decision is a severe setback for exploration investment, undermining investor confidence and weakening Australia’s long-term mineral resource pipeline.

“Without this pipeline, there is no downstream processing and manufacturing,” she said.

“Australia’s ability to respond effectively to global trade pressures and tariffs has been severely compromised by domestic policies that have eroded our industrial base and competitiveness.

“Rather than implementing urgently needed reforms to strengthen productivity, attract business investment, and control spending, the [Federal Government] has missed yet another opportunity, continuing to rely on mining revenues to cover uncontrolled expenditure.

“At a time of escalating geopolitical uncertainty, Australia urgently needs a resilient private sector to navigate the volatility of global markets and secure our economic and strategic interests.

“However, rather than strengthening industry competitiveness, the [Federal Government] continues to undermine business through restrictive policies and excessive regulation, placing Australia’s industries at a severe disadvantage compared to international competitors.

“Without decisive and fundamental action, Australia’s economic and fiscal problems will only deepen.”

Despite these shortfalls, the MCA and AMEC also recognise the continuation of the Future Made in Australia production tax credits as a positive step in ensuring global competitiveness and attracting long-term investment.

The hot projects and commodities in the Critical Minerals Prospectus can help carry the torch through the energy transition. But with the winds of change blowing, outside forces may inadvertently stimy the flame.

In future editions of the Australian Mining Review, we will investigate the challenges and opportunities across each of Australia’s critical minerals. Look out for our May edition, where we shine the light on vanadium’s prospects.