The rise of Vanadium flow batteries

Smart, renewable energy storage.

As the momentum in renewable energy contribution to energy networks grows, so does the demand for solutions that can store it for longer durations. This growth has led to a significant investment in emerging battery storage technologies that continue to shape the future clean energy landscape.

One such technology is vanadium flow batteries (VFBs), a fully commercialised utility scale battery storage solution. With VFB assets successfully operating globally at up to 800MWh of storage capacity, manufacturing plant capacities expanding to gigawatt scale, and a 500MWh battery now slated for development in Kalgoorlie, Western Australia, VFBs appear to be at the forefront of the growing global demand for long duration storage.

Perth-based Australian Vanadium Limited (ASX:AVL) is at the forefront of unlocking gigawatt-hour scale VFB deployment for long-duration energy storage in Australia.

Through its wholly owned subsidiary VSUN Energy, AVL offers long-duration energy storage solutions with many advantages including multi-decade life without performance degradation, improved cost effectiveness at longer durations, non-flammability, recyclability, and infinite flexibility to adapt power and duration to meet changing market needs.

VFBs are proven and have already stood the test of time: they have been around for over 40 years and grid-connected for almost 20 years. They work best and are most cost-effective for long duration (longer than 4 hours) with key market use cases in grid-connected utility-scale BESS, standalone power stations for the resource sector, and data centres. VFBs can provide a very reliable and uninterrupted power supply. And the best thing is: that the longer the duration is, the more compelling the economics can be. With eight-hour batteries now being deployed under strong market pricing signals in places like Australia for the first time ever, the time to watch VFB adoption has arrived.

Importantly, scaling a VFB supply chain is simple compared to other battery technologies. With more than half of a typical VFB value being the contained vanadium in electrolyte, there is a significant opportunity for Australian content through mining and processing of Australia’s vanadium resource endowment, and converting locally produced vanadium oxides into electrolyte. Having successfully deployed electrolyte into an operating VSUN Energy battery, Australian Vanadium is a first mover in unlocking this supply chain in Australia.

VFBs are today already doing anything lithium batteries can do and more in grid connected applications. Additionally, from a scalability perspective, a VFB is modular, allowing solutions to be tailored to meet a project’s unique energy requirements.

The Australian Mining Review spoke with AVL Chief Executive Officer Graham Arvidson to gain insight into why vanadium flow batteries are now being rolled out at GWh scale.

AMR: Can you provide some context to the current state of the vanadium market and how AVL is positioned to meet future energy demand

GA: The ability to scale the VFB supply chain is constrained only by the supply of one metal: vanadium. Australia is well endowed with vanadium deposits. AVL’s vertical integration strategy ensures a secure and stable supply of high-purity vanadium, a critical component of VFBs, allowing us to deliver cost-competitive solutions with the added benefit of local content.

The key driver of accelerated uptake of VFBs is economics, driven by the need for longer-duration solutions. VFBs are more cost-competitive the longer the duration. Other technologies like lithium-ion do not have this characteristic. Any application requiring greater than four hours is a place to look out for VFBs. Because of this, the three most exciting market segments where you should expect to see ongoing accelerated uptake of VFBs are grid-connected utility-scale batteries (for example, the market is now 8 hours in New South Wales), mining companies decarbonising, and data centres where batteries start at 12?hours and go up from there.

Economic forces driving gigawatt-hour scale installations in China have now arrived in Australia. Longer duration use cases mean the capital efficiency of the VFB improves further and becomes compelling. Coupled with falling costs as the technology is scaled beyond giga scale this becomes even more compelling. Watch out for the continued reduction in cost as many gigawatt-hour scale manufacturing bases continue to expand. With 35GWh of announced VFB factory based in the last two years, the implied growth trajectory of VFBs, and therefore vanadium production, is staggering.

Long duration is a new use case, so it’s understandable that it is not well known yet. But, it’s happening as we speak. One example is a 500MWh VFB that’s slated to be built in Kalgoorlie. With longer duration needs driving competitive economics, the other strengths of the battery then also come into play including longevity (lasting 30 years or longer without degradation), non-flammability (safety), recyclability (leading manufacturer Sumitomo Electric indicates >99% recyclable), and local content.

AMR: How does VFB technology work

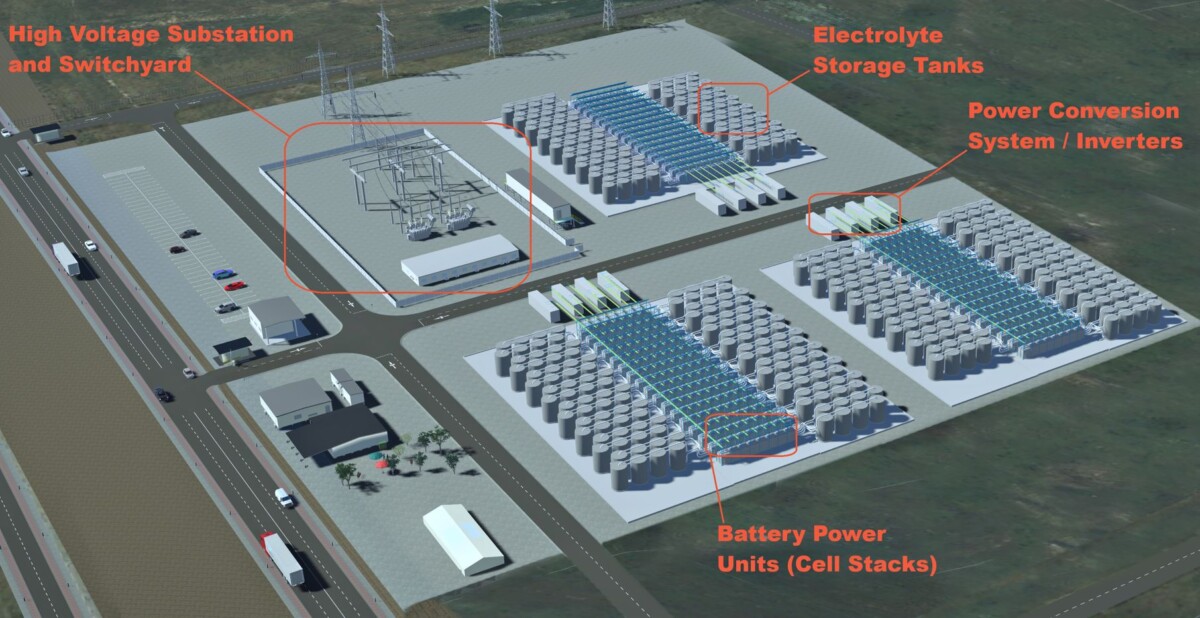

GA: VFB technology is based on a simple, elegant, and robust design. VFBs work by employing vanadium in different states to store chemical potential energy. The key ingredient, typically comprising over half the value of the VFB, is electrolyte made by processing vanadium oxides into an electrolyte solution. The electrolyte is stored in two tanks – one with a positively charged electrolyte solution and one with a negatively charged solution – which is pumped through power stacks to charge and discharge energy.

VFB’s superpower is that both the negative electrolyte and the positive electrolyte are identical, that is, because of vanadium’s unique characteristics the electrolyte solutions can move between four vanadium states and cycle over and over without degradation or cross-contamination issues. VFBs can also switch between charge and discharge instantaneously and can cycle often and deeply, differentiating it from its lithium-based technology. VFBs can also be left completely discharged for long periods with no ill effects and are arguably better suited to operating in hot climates, making them ideal long-duration energy storage solutions for locations like the Pilbara.

AMR: Can you explain some of the advantages of VFBs?

GA: Unlike traditional lithium-ion batteries, VFBs offer unparalleled durability, scalability, and safety. Their unique design allows for almost unlimited cycling without degradation, making them an ideal choice for applications requiring long-duration energy storage and grid stability.

Asset owners have peace of mind as there are manufacturers out there that provide warranties for more than 20 years with virtually no degradation in performance, which takes us back to the economics and increased longevity.

There are many other benefits too. The electrolyte solution is non-flammable, and not sensitive to extreme temperature fluctuations. This is important, particularly in Australia, where many regions are prone to bushfires, but also in the middle of suburbs where the risk of fires caused by lithium batteries is problematic and becoming less acceptable.

And then there is recyclability. Leading VFB manufacturer Sumitomo Electric in Japan, conducted a study on VFBs that highlighted greater than 99 per cent of the battery can be economically reused or recycled. This sustainability aspect only adds to the already positive economics of the battery technology in that when a VFB reaches the end of its life, the vanadium can be recycled into a new VFB or recovered for other use cases. This is something you just can’t do with other battery technologies.

AMR: How does AVL think about the VFB supply chain in Australia and the importance of partnerships for success?

GA:At Australian Vanadium, our vision is that Australia is perfectly positioned to leverage the opportunity presented by scaling a VFB industry to service the emerging and massive, long duration energy storage market. AVL’s strategy is expected to leverage strategic advantages in every aspect of the supply chain:

- Upstream: mining and processing to produce high purity vanadium oxides

- Midstream: converting high purity vanadium oxides to electrolyte ready for battery use

- Downstream: deploying cost-effective, proven, and scalable utility-scale solutions

Upstream at AVL, we have a high-grade, long mine life opportunity to mine and process high-purity vanadium oxides. Midstream, we are established electrolyte producers in Western Australia and seek to leverage the structural cost advantage of producing electrolyte locally. So, we essentially have both a geological and technological advantage, which we expect to continue to strengthen our position in energy storage and mining integration.

Downstream, we have our utility-scale VFB architecture, Project Lumina. Project Lumina is nearing development completion in creating a modular, turnkey and scalable utility-scale battery energy storage system using VFBs specifically for the Australian market. Importantly, the aim of Project Lumina is to deliver a compelling lifecycle cost, or what energy industry refers to as Levelised Cost of Storage (LCOS). A competitive LCOS is the hallmark of technologies that get adopted at scale, and delivering the most compelling LCOS that we can through Project Lumina is how we see competitive advantage being delivered. We aim to have our Project Lumina utility scale architecture ready for financial investment by Q3 this year.

For us at AVL, partnerships matter. And for Project Lumina we have selected our partners to ensure we can deliver a proven solution. The first being Genus Group here in WA, which has some of the largest BESS assets in Australia. Genus has the proven capability and expertise in building utility-scale BESS solutions using lithium-ion batteries. Their expertise maps well onto our VFB solutions. So, it’s a strategic fit for us.

In terms of the battery power stacks, we have partnered with CellCube, an Austrian company and leader in VFB technology. They design and manufacture the longest-running battery in the market capable of ensuring reliable power for 4 to over 24 hours. They have been around for almost 20 years and have hundreds of batteries operating all around the world.

In addition to our Project Lumina partners, we also recognise that industry partners will be essential to maximise the opportunity for AVL and VSUN Energy. Whether funding partners, land access partners, energy offtake partners, or government support, all of this plays a crucial role in advancing the integration of our large-scale, off-the-shelf VFB solutions into more successful projects. At AVL and VSUN Energy we are pursuing these partnerships across five states where we expect to see very large-scale VFBs adopted soon.

We have strategically positioned ourselves to be ready to deliver on a utility scale. Whether that is a 500 MWh requirement in Kalgoorlie, Western Australia, or gigawatt-hour scale projects on the east coast, we have done all the work: from design and construction to execution, and commissioning.

As our downstream business unlocks utility-scale VFBs, we continue to position the rest of our supply chain to strategically deliver. That’s what excites us the most.