Barton builds up for South Australian gold rush

Barton Gold (ASX: BGD) is looking to lead the re-emergence of South Australian gold. Building on rosy financials, with an after-tax profit of $3.1m for H2 CY24 and revenue ticking over at a healthy $8.5m, the company is gearing up for an aggressive, dual-track expansion throughout 2025 and 2026.

Barton has the infrastructure to quickly and cheaply step from its current ‘explorer’ mode to ‘producer’ and then self-fund. To achieve this, the miner is leveraging near and long-term production assets.

Barton Gold is spreading its wings with the management of two neighbouring gold projects. There’s the sprawling Tarcoola project, covering a massive 1640km2 of tenements near Barton’s Central Gawler Mill. The miner is looking to leverage both its mill and Tarcoola’s high-grade history — its fully permitted Perseverance Mine fed high-grade ore to Barton’s Central Gawler Mill as recently as 2018 and will form a key part of Barton’s ‘Stage 1’ operations strategy for 2026.

Next door, Barton has the resource-rich Tunkillia project, which sits on 1360km2 and has a 1.6moz gold and 3.1moz silver JORC Resource to serve as it ‘Stage 2’ growth project.

Tunkillia’s recently published optimised scoping study highlights a large-scale 5mtpa operation producing 120kozpa of gold and 250kozpa of silver, for $2.7b operating free cash, a 73% equity IRR and a .8 year payback period.

The Stage 1 / 2 ‘Start Pit’ produces about $1.3b operating free cash during the first ~2.5 years alone, paying back its development cost three times over. With a strike length of 4.5km, the project may have even more potential below the surface, with the next 20km of the shear zone on which its deposit sits largely untested.

Barton is also now expediting exploration at the Tolmer silver-gold prospect following the very recent discovery of neighbouring high-grade silver and gold zones emerging in parallel, which have yielded shallow assays grading up to 17,600g/t of silver and 83.6g/t of gold.

The miner also recently surprised the market with a share placement at a 4% premium to its closing price, and a 25% premium to its one month value weighted average price (VWAP), a rare feat for any mining developer and reflective of significant demand for Barton’s widely regarded limited share offerings and its low-dilution funding model.

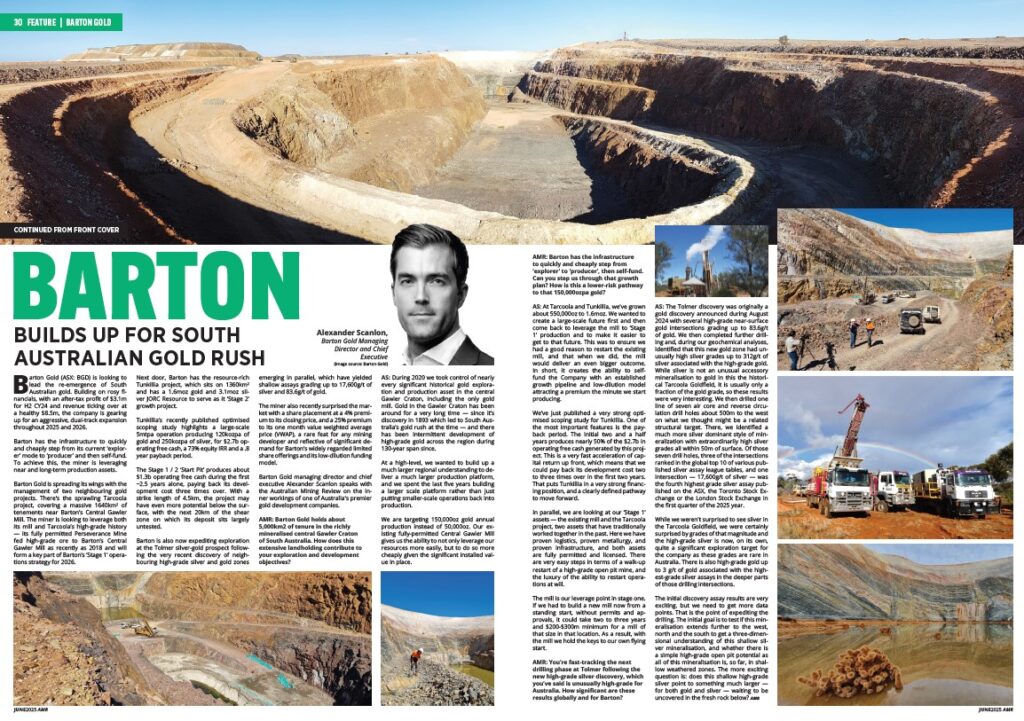

Barton Gold managing director and chief executive Alexander Scanlon speaks with the Australian Mining Review on the inner workings of one of Australia’s premier gold development companies.

AMR: Barton Gold holds about 5,000km2 of tenure in the richly mineralised central Gawler Craton of South Australia. How does this extensive landholding contribute to your exploration and development objectives?

AS: During 2020 we took control of nearly every significant historical gold exploration and production asset in the central Gawler Craton, including the only gold mill. Gold in the Gawler Craton has been around for a very long time — since it’s discovery in 1893 which led to South Australia’s gold rush at the time — and there has been intermittent development of high-grade gold across the region during 130-year span since.

At a high-level, we wanted to build up a much larger regional understanding to deliver a much larger production platform, and we spent the last five years building a larger scale platform rather than just putting smaller-scale operations back into production.

We are targeting 150,000oz gold annual production instead of 50,000oz. Our existing fully-permitted Central Gawler Mill gives us the ability to not only leverage our resources more easily, but to do so more cheaply given the significant installed value in place.

AMR: Barton has the infrastructure to quickly and cheaply step from ‘explorer’ to ‘producer’, then self-fund. Can you step us through that growth plan? How is this a lower-risk pathway to that 150,000ozpa gold?

AS: At Tarcoola and Tunkillia, we’ve grown about 550,000oz to 1.6moz. We wanted to create a large-scale future first and then come back to leverage the mill to ‘Stage 1’ production and to make it easier to get to that future. This was to ensure we had a good reason to restart the existing mill, and that when we did, the mill would deliver an even bigger outcome. In short, it creates the ability to self-fund the Company with an established growth pipeline and low-dilution model attracting a premium the minute we start producing.

We’ve just published a very strong optimised scoping study for Tunkillia. One of the most important features is the payback period. The initial two and a half years produces nearly 50% of the $2.7b in operating free cash generated by this project. This is a very fast acceleration of capital return up front, which means that we could pay back its development cost two to three times over in the first two years. That puts Tunkillia in a very strong financing position, and a clearly defined pathway to move forward.

In parallel, we are looking at our ‘Stage 1’ assets — the existing mill and the Tarcoola project, two assets that have traditionally worked together in the past. Here we have proven logistics, proven metallurgy, and proven infrastructure, and both assets are fully permitted and licensed. There are very easy steps in terms of a walk-up restart of a high-grade open pit mine, and the luxury of the ability to restart operations at will.

The mill is our leverage point in stage one. If we had to build a new mill now from a standing start, without permits and approvals, it could take two to three years and $200-$300m minimum for a mill of that size in that location. As a result, with the mill we hold the keys to our own flying start.

AMR: You’re fast-tracking the next drilling phase at Tolmer following the new high-grade silver discovery, which you’ve said is unusually high-grade for Australia. How significant are these results globally and for Barton?

AS: The Tolmer discovery was originally a gold discovery announced during August 2024 with several high-grade near-surface gold intersections grading up to 83.6g/t of gold. We then completed further drilling and, during our geochemical analyses, identified that this new gold zone had unusually high silver grades up to 312g/t of silver associated with the high-grade gold. While silver is not an unusual accessory mineralisation to gold in this the historical Tarcoola Goldfield, it is usually only a fraction of the gold grade, so these results were very interesting. We then drilled one line of seven air core and reverse circulation drill holes about 500m to the west on what we thought might be a related structural target. There, we identified a much more silver dominant style of mineralization with extraordinarily high silver grades all within 50m of surface. Of those seven drill holes, three of the intersections ranked in the global top 10 of various published silver assay league tables, and one intersection — 17,600g/t of silver — was the fourth highest grade silver assay published on the ASX, the Toronto Stock Exchange or the London Stock Exchange in the first quarter of the 2025 year.

While we weren’t surprised to see silver in the Tarcoola Goldfield, we were certainly surprised by grades of that magnitude and the high-grade silver is now, on its own, quite a significant exploration target for the company as these grades are rare in Australia. There is also high-grade gold up to 3 g/t of gold associated with the highest-grade silver assays in the deeper parts of those drilling intersections.

The initial discovery assay results are very exciting, but we need to get more data points. That is the point of expediting the drilling. The initial goal is to test if this mineralisation extends further to the west, north and the south to get a three-dimensional understanding of this shallow silver mineralisation, and whether there is a simple high-grade open pit potential as all of this mineralisation is, so far, in shallow weathered zones. The more exciting question is: does this shallow high-grade silver point to something much larger — for both gold and silver — waiting to be uncovered in the fresh rock below?