Securing ‘ex-China’ graphite supply

Renascor Resources (ASX: RNU) is moving ahead with plans to develop one of the world’s most advanced vertically integrated graphite operations, aiming to supply sustainably sourced purified spherical graphite (PSG) for use in lithium-ion batteries.

The South Australia-based company has completed feasibility and engineering work for its upstream mining project and is preparing to commission a downstream demonstration plant that could enable the company to produce high-purity graphite without the use of hydrofluoric acid (HF) — a key differentiator in the market.

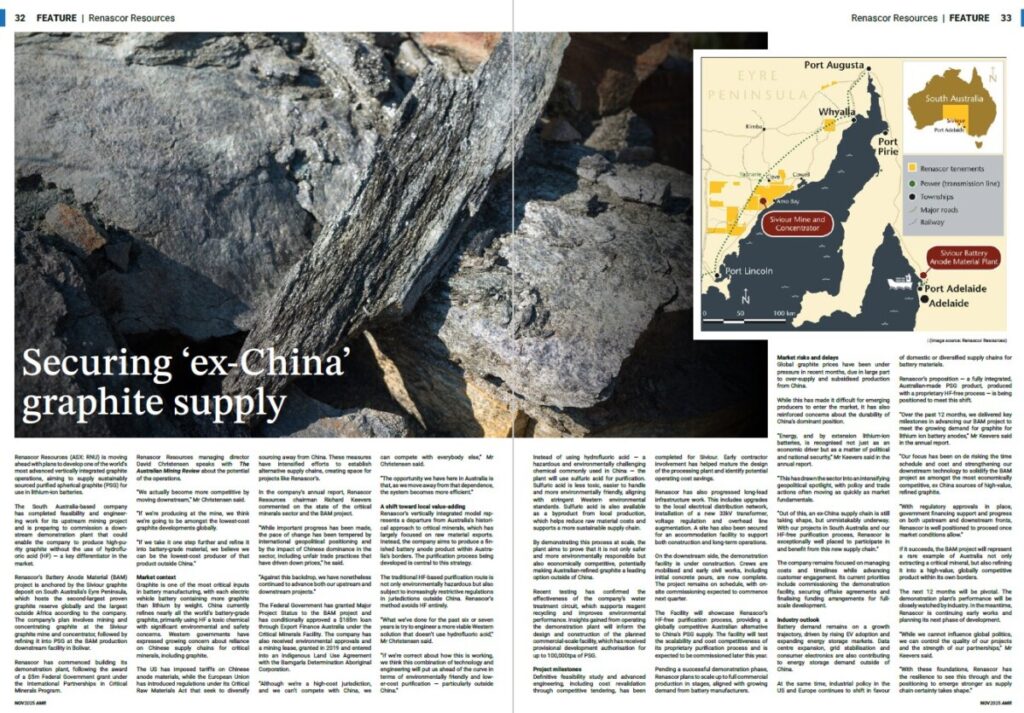

Renascor’s Battery Anode Material (BAM) project is anchored by the Siviour graphite deposit on South Australia’s Eyre Peninsula, which hosts the second-largest proven graphite reserve globally and the largest outside Africa according to the company. The company’s plan involves mining and concentrating graphite at the Siviour graphite mine and concentrator, followed by refining it into PSG at the BAM production downstream facility in Bolivar.

Renascor has commenced building its demonstration plant, following the award of a $5m Federal Government grant under the International Partnerships in Critical Minerals Program.

Renascor Resources managing director David Christensen speaks with The Australian Mining Review about the potential of the operations.

“We actually become more competitive by moving downstream,” Mr Christensen said.

“If we’re producing at the mine, we think we’re going to be amongst the lowest-cost graphite developments globally.

“If we take it one step further and refine it into battery-grade material, we believe we can be the lowest-cost producer of that product outside China.”

Market context

Graphite is one of the most critical inputs in battery manufacturing, with each electric vehicle battery containing more graphite than lithium by weight. China currently refines nearly all the world’s battery-grade graphite, primarily using HF a toxic chemical with significant environmental and safety concerns. Western governments have expressed growing concern about reliance on Chinese supply chains for critical minerals, including graphite.

The US has imposed tariffs on Chinese anode materials, while the European Union has introduced regulations under its Critical Raw Materials Act that seek to diversify sourcing away from China. These measures have intensified efforts to establish alternative supply chains, creating space for projects like Renascor’s.

In the company’s annual report, Renascor Resources chairman Richard Keevers commented on the state of the critical minerals sector and the BAM project.

“While important progress has been made, the pace of change has been tempered by international geopolitical positioning and by the impact of Chinese dominance in the sector, including unfair trade practices that have driven down prices,” he said.

“Against this backdrop, we have nonetheless continued to advance both our upstream and downstream projects.”

The Federal Government has granted Major Project Status to the BAM project and has conditionally approved a $185m loan through Export Finance Australia under the Critical Minerals Facility. The company has also received environmental approvals and a mining lease, granted in 2019 and entered into an Indigenous Land Use Agreement with the Barngarla Determination Aboriginal Corporation.

“Although we’re a high-cost jurisdiction, and we can’t compete with China, we can compete with everybody else,” Mr Christensen said.

“The opportunity we have here in Australia is that, as we move away from that dependence, the system becomes more efficient.”

A shift toward local value-adding

Renascor’s vertically integrated model represents a departure from Australia’s historical approach to critical minerals, which has largely focused on raw material exports. Instead, the company aims to produce a finished battery anode product within Australia’s borders. The purification process being developed is central to this strategy.

The traditional HF-based purification route is not only environmentally hazardous but also subject to increasingly restrictive regulations in jurisdictions outside China. Renascor’s method avoids HF entirely.

“What we’ve done for the past six or seven years is try to engineer a more viable Western solution that doesn’t use hydrofluoric acid,” Mr Christensen said.

“If we’re correct about how this is working, we think this combination of technology and engineering will put us ahead of the curve in terms of environmentally friendly and lower-cost purification — particularly outside China.”

Instead of using hydrofluoric acid — a hazardous and environmentally challenging chemical commonly used in China — the plant will use sulfuric acid for purification. Sulfuric acid is less toxic, easier to handle and more environmentally friendly, aligning with stringent Western environmental standards. Sulfuric acid is also available as a byproduct from local production, which helps reduce raw material costs and supports a more sustainable supply chain.

By demonstrating this process at scale, the plant aims to prove that it is not only safer and more environmentally responsible but also economically competitive, potentially making Australian-refined graphite a leading option outside of China.

Recent testing has confirmed the effectiveness of the company’s water treatment circuit, which supports reagent recycling and improves environmental performance. Insights gained from operating the demonstration plant will inform the design and construction of the planned commercial-scale facility, which has received provisional development authorisation for up to 100,000tpa of PSG.

Project milestones

Definitive feasibility study and advanced engineering, including cost revalidation through competitive tendering, has been completed for Siviour. Early contractor involvement has helped mature the design of the processing plant and identify potential operating cost savings.

Renascor has also progressed long-lead infrastructure work. This includes upgrades to the local electrical distribution network, installation of a new 33kV transformer, voltage regulation and overhead line augmentation. A site has also been secured for an accommodation facility to support both construction and long-term operations.

On the downstream side, the demonstration facility is under construction. Crews are mobilised and early civil works, including initial concrete pours, are now complete. The project remains on schedule, with on-site commissioning expected to commence next quarter.

The Facility will showcase Renascor’s HF-free purification process, providing a globally competitive Australian alternative to China’s PSG supply. The facility will test the scalability and cost competitiveness of its proprietary purification process and is expected to be commissioned later this year.

Pending a successful demonstration phase, Renascor plans to scale up to full commercial production in stages, aligned with growing demand from battery manufacturers.

Market risks and delays

Global graphite prices have been under pressure in recent months, due in large part to over-supply and subsidised production from China.

While this has made it difficult for emerging producers to enter the market, it has also reinforced concerns about the durability of China’s dominant position.

“Energy, and by extension lithium-ion batteries, is recognised not just as an economic driver but as a matter of political and national security,” Mr Keevers said in the annual report.

“This has drawn the sector into an intensifying geopolitical spotlight, with policy and trade actions often moving as quickly as market fundamentals.

“Out of this, an ex-China supply chain is still taking shape, but unmistakably underway. With our projects in South Australia and our HF-free purification process, Renascor is exceptionally well placed to participate in and benefit from this new supply chain.”

The company remains focused on managing costs and timelines while advancing customer engagement. Its current priorities include commissioning the demonstration facility, securing offtake agreements and finalising funding arrangements for full-scale development.

Industry outlook

Battery demand remains on a growth trajectory, driven by rising EV adoption and expanding energy storage markets. Data centre expansion, grid stabilisation and consumer electronics are also contributing to energy storage demand outside of China.

At the same time, industrial policy in the US and Europe continues to shift in favour of domestic or diversified supply chains for battery materials.

Renascor’s proposition — a fully integrated, Australian-made PSG product, produced with a proprietary HF-free process — is being positioned to meet this shift.

“Over the past 12 months, we delivered key milestones in advancing our BAM project to meet the growing demand for graphite for lithium?ion battery anodes,” Mr Keevers said in the annual report.

“Our focus has been on de?risking the time schedule and cost and strengthening our downstream technology to solidify the BAM project as amongst the most economically competitive, ex?China sources of high-value, refined graphite.

“With regulatory approvals in place, government financing support and progress on both upstream and downstream fronts, Renascor is well positioned to proceed once market conditions allow.”

If it succeeds, the BAM project will represent a rare example of Australia not only extracting a critical mineral, but also refining it into a high-value, globally competitive product within its own borders.

The next 12 months will be pivotal. The demonstration plant’s performance will be closely watched by industry. In the meantime, Renascor is continuing early works and planning its next phase of development.

“While we cannot influence global politics, we can control the quality of our projects and the strength of our partnerships,” Mr Keevers said.

“With these foundations, Renascor has the resilience to see this through and the positioning to emerge stronger as supply chain certainty takes shape.”