Olympic Dam

The key to electrifying the future

The world’s demand for energy and infrastructure continues to rise as populations grow and countries urbanise.

Copper is an irreplaceable conductor essential to global electrification that underpins this growth.

With 97% efficiency in electrical transmission, exceptional durability and thermal conductivity, copper is a key component in renewable energy generation and storage, grid infrastructure and electric vehicles (EVs).

The shift to renewable energy systems will require an additional 2mtpa of copper supply over the next decade, according to Wood Mackenzie. While this growth trajectory seems certain, Wood Mackenzie warns that disruptors could amplify demand and price volatility beyond expectations — potentially adding an extra 40% to total copper demand growth by 2035.

Unlike the 20th century, where the adoption of cars, electricity, consumer electronics and white goods occurred at different times across various regions, copper demand from electrification, decarbonisation and digitisation will cut across high, middle and lower-income economies alike as the entire world moves to net-zero by 2050.

BHP copper South Australia asset president Anna Wiley says copper is a metal of the future.

“Global copper demand is projected to grow 70% by 2050, driven by rising living standards, increased housing, the accelerating energy transition and the boom in data centers,” she said.

The last 30 years has seen impressive supply growth globally, with production doubling to about 22mtpa today, according to BHP (ASX: BHP).

Latin America is the largest producer of mined copper with majority of copper from being exported before being refined and fabricated into end-use products in other regions, according to the International Copper Association (ICA).

China is the largest producer of refined copper and, in 2020, produced 11.87mt of end-use copper products, the ICA reports.

The geopolitical implications of copper supply chains have become increasingly apparent as nations seek to reduce reliance on volatile energy imports as supply chains are disrupted.

Australia’s copper landscape

Australia hosts 10% of global copper resources yet contributes just 4% to global copper production, according to the South Australia Energy and Mining Department (SA DEM). There is rising interest in developing copper resources across Australia, primarily concentrated in South Australia which holds about 68% of these reserves.

South Australia is Australia’s premier copper-producing region. In FY25, copper exports reached a record high of $4.3b — an increase of 17% increase from the previous year according to SA DEM.

There is one established mine that has been at the forefront of Australian copper since 1988 — and is expected to lead the industry for more than a century.

BHP’s (ASX: BHP) Olympic Dam in South Australia is the single largest copper mine in the country boasting a 10.4bt resource. The site has produced more than 300,000tpa of copper consistently for the last three years and produces about 900t of copper per day, based on total FY25 production of about 316,000t.

The site was named after a livestock watering dam on the Roxby Downs pastoral lease under which the ore body lies. The dam was built during the Melbourne Olympic Games in 1956 and is very close to the discovery drill site.

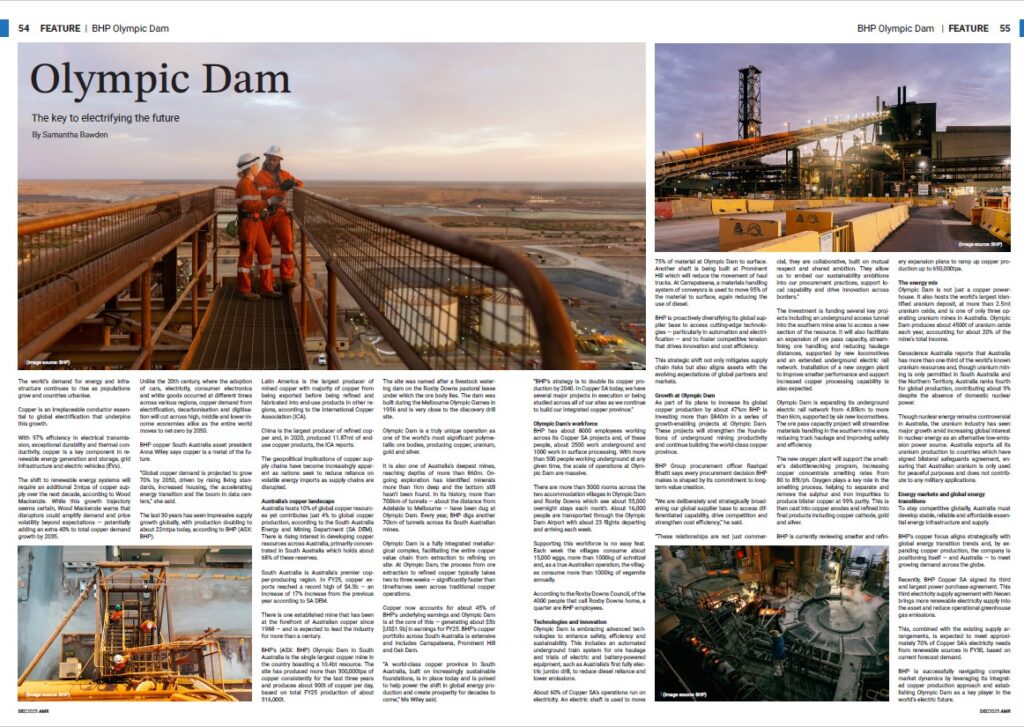

Olympic Dam is a truly unique operation as one of the world’s most significant polymetallic ore bodies, producing copper, uranium, gold and silver.

It is also one of Australia’s deepest mines, reaching depths of more than 860m. Ongoing exploration has identified minerals more than 1km deep and the bottom still hasn’t been found. In its history, more than 700km of tunnels — about the distance from Adelaide to Melbourne — have been dug at Olympic Dam. Every year, BHP digs another 70km of tunnels across its South Australian mines.

Olympic Dam is a fully integrated metallurgical complex, facilitating the entire copper value chain from extraction to refining on site. At Olympic Dam, the process from ore extraction to refined copper typically takes two to three weeks — significantly faster than timeframes seen across traditional copper operations.

Copper now accounts for about 45% of BHP’s underlying earnings and Olympic Dam is at the core of this — generating about $3b [US$1.9b] in earnings for FY25. BHP’s copper portfolio across South Australia is extensive and includes Carrapateena, Prominent Hill and Oak Dam.

“A world-class copper province in South Australia, built on increasingly sustainable foundations, is in place today and is poised to help power the shift in global energy production and create prosperity for decades to come,” Ms Wiley said.

“BHP’s strategy is to double its copper production by 2040. In Copper SA today, we have several major projects in execution or being studied across all of our sites as we continue to build our integrated copper province.”

Olympic Dam’s workforce

BHP has about 8000 employees working across its Copper SA projects and, of these people, about 2500 work underground and 1000 work in surface processing. With more than 500 people working underground at any given time, the scale of operations at Olympic Dam are massive.

There are more than 3000 rooms across the two accommodation villages in Olympic Dam and Roxby Downs which see about 55,000 overnight stays each month. About 16,000 people are transported through the Olympic Dam Airport with about 23 flights departing and arriving each week.

Supporting this workforce is no easy feat. Each week the villages consume about 15,000 eggs, more than 1000kg of schnitzel and, as a true Australian operation, the villages consume more than 1000kg of vegemite annually.

According to the Roxby Downs Council, of the 4000 people that call Roxby Downs home, a quarter are BHP employees.

Technologies and innovation

Olympic Dam is embracing advanced technologies to enhance safety, efficiency and sustainability. This includes an automated underground train system for ore haulage and trials of electric and battery-powered equipment, such as Australia’s first fully electric jumbo drill, to reduce diesel reliance and lower emissions.

About 60% of Copper SA’s operations run on electricity. An electric shaft is used to move 75% of material at Olympic Dam to surface. Another shaft is being built at Prominent Hill which will reduce the movement of haul trucks. At Carrapateena, a materials handling system of conveyors is used to move 95% of the material to surface, again reducing the use of diesel.

BHP is proactively diversifying its global supplier base to access cutting-edge technologies — particularly in automation and electrification — and to foster competitive tension that drives innovation and cost efficiency.

This strategic shift not only mitigates supply chain risks but also aligns assets with the evolving expectations of global partners and markets.

Growth at Olympic Dam

As part of its plans to increase its global copper production by about 47%m BHP is investing more than $840m in a series of growth-enabling projects at Olympic Dam. These projects will strengthen the foundations of underground mining productivity and continue building the world-class copper province.

BHP Group procurement officer Rashpal Bhatti says every procurement decision BHP makes is shaped by its commitment to long-term value creation.

“We are deliberately and strategically broadening our global supplier base to access differentiated capability, drive competition and strengthen cost efficiency,” he said.

“These relationships are not just commercial, they are collaborative, built on mutual respect and shared ambition. They allow us to embed our sustainability ambitions into our procurement practices, support local capability and drive innovation across borders.”

The investment is funding several key projects including an underground access tunnel into the southern mine area to access a new section of the resource. It will also facilitate an expansion of ore pass capacity, streamlining ore handling and reducing haulage distances, supported by new locomotives and an extended underground electric rail network. Installation of a new oxygen plant to improve smelter performance and support increased copper processing capability is also expected.

Olympic Dam is expanding its underground electric rail network from 4.85km to more than 6km, supported by six new locomotives. The ore pass capacity project will streamline materials handling in the southern mine area, reducing truck haulage and improving safety and efficiency.

The new oxygen plant will support the smelter’s debottlenecking program, increasing copper concentrate smelting rates from 80 to 85t/ph. Oxygen plays a key role in the smelting process, helping to separate and remove the sulphur and iron impurities to produce blister copper at 99% purity. This is then cast into copper anodes and refined into final products including copper cathode, gold and silver.

BHP is currently reviewing smelter and refinery expansion plans to ramp up copper production up to 650,000tpa.

The energy mix

Olympic Dam is not just a copper powerhouse. It also hosts the world’s largest identified uranium deposit, at more than 2.5mt uranium oxide, and is one of only three operating uranium mines in Australia. Olympic Dam produces about 4500t of uranium oxide each year, accounting for about 20% of the mine’s total income.

Geoscience Australia reports that Australia has more than one-third of the world’s known uranium resources and, though uranium mining is only permitted in South Australia and the Northern Territory, Australia ranks fourth for global production, contributing about 9% despite the absence of domestic nuclear power.

Though nuclear energy remains controversial in Australia, the uranium industry has seen major growth amid increasing global interest in nuclear energy as an alternative low-emission power source. Australia exports all its uranium production to countries which have signed bilateral safeguards agreement, ensuring that Australian uranium is only used for peaceful purposes and does not contribute to any military applications.

Energy markets and global energy transitions

To stay competitive globally, Australia must develop stable, reliable and affordable essential energy infrastructure and supply.

BHP’s copper focus aligns strategically with global energy transition trends and, by expanding copper production, the company is positioning itself — and Australia — to meet growing demand across the globe.

Recently, BHP Copper SA signed its third and largest power purchase agreement. This third electricity supply agreement with Neoen brings more renewable electricity supply into the asset and reduce operational greenhouse gas emissions.

This, combined with the existing supply arrangements, is expected to meet approximately 70% of Copper SA’s electricity needs from renewable sources in FY30, based on current forecast demand.

BHP is successfully navigating complex market dynamics by leveraging its integrated copper production approach and establishing Olympic Dam as a key player in the world’s electric future.