Turning the tide of Australian copper

As a crucial component of renewable energy technologies, the global energy transition is profoundly reshaping copper consumption patterns worldwide.

According to Wood Mackenzie, global copper demand is expected to surge by 24%, rising from 8.2mtpa to 42.7mtpa, by 2035.

The geopolitical implications of copper supply chains have become increasingly apparent as nations seek to reduce reliance on volatile energy imports and diversify supply chains.

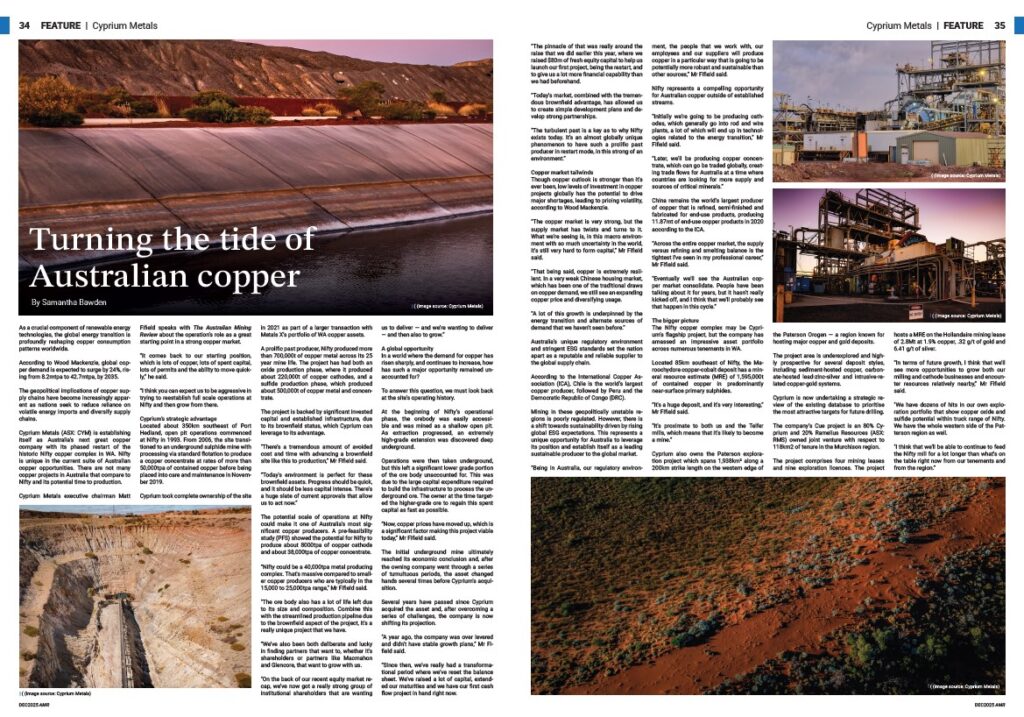

Cyprium Metals (ASX: CYM) is establishing itself as Australia’s next great copper company with its phased restart of the historic Nifty copper complex in WA. Nifty is unique in the current suite of Australian copper opportunities. There are not many copper projects in Australia that compare to Nifty and its potential time to production.

Cyprium Metals executive chairman Matt Fifield speaks with The Australian Mining Review about the operation’s role as a great starting point in a strong copper market.

“It comes back to our starting position, which is lots of copper, lots of spent capital, lots of permits and the ability to move quickly,” he said.

“I think you can expect us to be aggressive in trying to reestablish full scale operations at Nifty and then grow from there.”

Cyprium’s strategic advantage

Located about 350km southeast of Port Hedland, open pit operations commenced at Nifty in 1993. From 2006, the site transitioned to an underground sulphide mine with processing via standard flotation to produce a copper concentrate at rates of more than 50,000tpa of contained copper before being placed into care and maintenance in November 2019.

Cyprium took complete ownership of the site in 2021 as part of a larger transaction with Metals X’s portfolio of WA copper assets.

A prolific past producer, Nifty produced more than 700,000t of copper metal across its 25 year mine life. The project has had both an oxide production phase, where it produced about 220,000t of copper cathodes, and a sulfide production phase, which produced about 500,000t of copper metal and concentrate.

The project is backed by significant invested capital and established infrastructure, due to its brownfield status, which Cyprium can leverage to its advantage.

“There’s a tremendous amount of avoided cost and time with advancing a brownfield site like this to production,” Mr Fifield said.

“Today’s environment is perfect for these brownfield assets. Progress should be quick, and it should be less capital intense. There’s a huge slate of current approvals that allow us to act now.”

The potential scale of operations at Nifty could make it one of Australia’s most significant copper producers. A pre-feasibility study (PFS) showed the potential for Nifty to produce about 8000tpa of copper cathode and about 38,000tpa of copper concentrate.

“Nifty could be a 40,000tpa metal producing complex. That’s massive compared to smaller copper producers who are typically in the 15,000 to 25,000tpa range,” Mr Fifield said.

“The ore body also has a lot of life left due to its size and composition. Combine this with the streamlined production pipeline due to the brownfield aspect of the project, it’s a really unique project that we have.

“We’ve also been both deliberate and lucky in finding partners that want to, whether it’s shareholders or partners like Macmahon and Glencore, that want to grow with us.

“On the back of our recent equity market recap, we’ve now got a really strong group of institutional shareholders that are wanting us to deliver — and we’re wanting to deliver — and then also to grow.”

A global opportunity

In a world where the demand for copper has risen sharply, and continues to increase, how has such a major opportunity remained unaccounted for?

To answer this question, we must look back at the site’s operating history.

At the beginning of Nifty’s operational phase, the orebody was easily accessible and was mined as a shallow open pit. As extraction progressed, an extremely high-grade extension was discovered deep underground.

Operations were then taken underground, but this left a significant lower grade portion of the ore body unaccounted for. This was due to the large capital expenditure required to build the infrastructure to process the underground ore. The owner at the time targeted the higher-grade ore to regain this spent capital as fast as possible.

“Now, copper prices have moved up, which is a significant factor making this project viable today,” Mr Fifield said.

The initial underground mine ultimately reached its economic conclusion and, after the owning company went through a series of tumultuous periods, the asset changed hands several times before Cyprium’s acquisition.

Several years have passed since Cyprium acquired the asset and, after overcoming a series of challenges, the company is now shifting its projection.

“A year ago, the company was over levered and didn’t have stable growth plans,” Mr Fifield said.

“Since then, we’ve really had a transformational period where we’ve reset the balance sheet. We’ve raised a lot of capital, extended our maturities and we have our first cash flow project in hand right now.

“The pinnacle of that was really around the raise that we did earlier this year, where we raised $80m of fresh equity capital to help us launch our first project, being the restart, and to give us a lot more financial capability than we had beforehand.

“Today’s market, combined with the tremendous brownfield advantage, has allowed us to create simple development plans and develop strong partnerships.

“The turbulent past is a key as to why Nifty exists today. It’s an almost globally unique phenomenon to have such a prolific past producer in restart mode, in this strong of an environment.”

Copper market tailwinds

Though copper outlook is stronger than it’s ever been, low levels of investment in copper projects globally has the potential to drive major shortages, leading to pricing volatility, according to Wood Mackenzie.

“The copper market is very strong, but the supply market has twists and turns to it. What we’re seeing is, in this macro environment with so much uncertainty in the world, it’s still very hard to form capital,” Mr Fifield said.

“That being said, copper is extremely resilient. In a very weak Chinese housing market, which has been one of the traditional draws on copper demand, we still see an expanding copper price and diversifying usage.

“A lot of this growth is underpinned by the energy transition and alternate sources of demand that we haven’t seen before.”

Australia’s unique regulatory environment and stringent ESG standards set the nation apart as a reputable and reliable supplier to the global supply chain.

According to the International Copper Association (ICA), Chile is the world’s largest copper producer, followed by Peru and the Democratic Republic of Congo (DRC).

Mining in these geopolitically unstable regions is poorly regulated. However, there is a shift towards sustainability driven by rising global ESG expectations. This represents a unique opportunity for Australia to leverage its position and establish itself as a leading sustainable producer to the global market.

“Being in Australia, our regulatory environment, the people that we work with, our employees and our suppliers will produce copper in a particular way that is going to be potentially more robust and sustainable than other sources,” Mr Fifield said.

Nifty represents a compelling opportunity for Australian copper outside of established streams.

“Initially we’re going to be producing cathodes, which generally go into rod and wire plants, a lot of which will end up in technologies related to the energy transition,” Mr Fifield said.

“Later, we’ll be producing copper concentrate, which can go be traded globally, creating trade flows for Australia at a time where countries are looking for more supply and sources of critical minerals.”

China remains the world’s largest producer of copper that is refined, semi-finished and fabricated for end-use products, producing 11.87mt of end-use copper products in 2020 according to the ICA.

“Across the entire copper market, the supply versus refining and smelting balance is the tightest I’ve seen in my professional career,” Mr Fifield said.

“Eventually we’ll see the Australian copper market consolidate. People have been talking about it for years, but it hasn’t really kicked off, and I think that we’ll probably see that happen in this cycle.”

The bigger picture

The Nifty copper complex may be Cyprium’s flagship project, but the company has amassed an impressive asset portfolio across numerous tenements in WA.

Located 85km southeast of Nifty, the Maroochydore copper-cobalt deposit has a mineral resource estimate (MRE) of 1,595,000t of contained copper in predominantly near-surface primary sulphides.

“It’s a huge deposit, and it’s very interesting,” Mr Fifield said.

“It’s proximate to both us and the Telfer mills, which means that it’s likely to become a mine.”

Cyprium also owns the Paterson exploration project which spans 1,938km² along a 200km strike length on the western edge of the Paterson Orogen — a region known for hosting major copper and gold deposits.

The project area is underexplored and highly prospective for several deposit styles, including sediment-hosted copper, carbonate-hosted lead-zinc-silver and intrusive-related copper-gold systems.

Cyprium is now undertaking a strategic review of the existing database to prioritise the most attractive targets for future drilling.

The company’s Cue project is an 80% Cyprium and 20% Ramelius Resources (ASX: RMS) owned joint venture with respect to 118km2 of tenure in the Murchison region.

The project comprises four mining leases and nine exploration licences. The project hosts a MRE on the Hollandaire mining lease of 2.8Mt at 1.9% copper, .32 g/t of gold and 6.41 g/t of silver.

“In terms of future growth, I think that we’ll see more opportunities to grow both our milling and cathode businesses and encounter resources relatively nearby,” Mr Fifield said.

“We have dozens of hits in our own exploration portfolio that show copper oxide and sulfide potential within truck range of Nifty. We have the whole western side of the Patterson region as well.

“I think that we’ll be able to continue to feed the Nifty mill for a lot longer than what’s on the table right now from our tenements and from the region.”