Boom to bust and back again: mining’s impact on housing

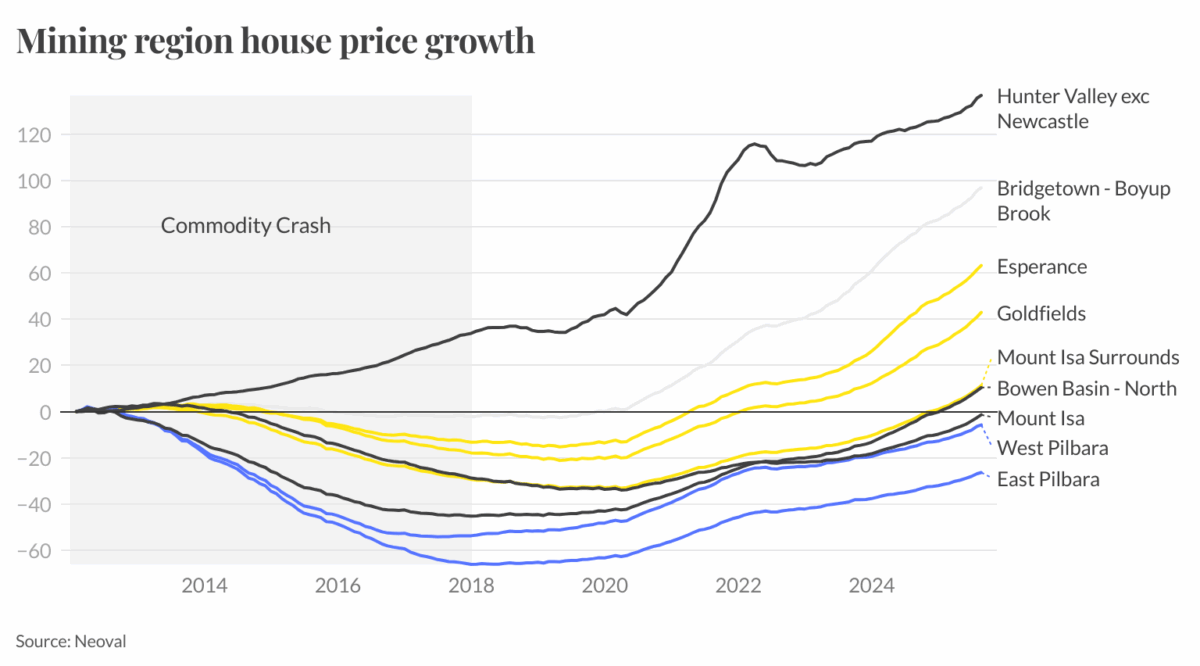

Housing prices across Australia’s mining regions are some of the most volatile in the country, with some areas, over the last two decades, crashing more than 65% at the end of a mining boom.

An analysis featured in the upcoming 2025 Ray White Regional Report investigates housing price dynamics across nine of Australia’s major mining regions over the last decade — from coal districts in Queensland and NSW, the iron ore centres of the Pilbara, gold rich regions of WA to emerging lithium hotspots.

The period from 2012 to 2017 delivered brutal house price corrections across Australia’s mining districts, with an average crash of 31.5% from peaks. Three regions suffered crashes exceeding 40%, demonstrating the extreme vulnerability of resource-dependent housing markets.

The East Pilbara experienced the most severe correction, with prices collapsing 66.8% from its 2012 average of $718,189 to a trough of $238,170 in 2017 — wiping out $480,019 in median house value.

The West Pilbara saw house prices plummet 55.1% from its 2010 peak of $704,290 to a 2017 low of $315,954.

It is a similar story on the other side of the country in the Queensland coal regions. In the Bowen Basin house prices fell 45.9% from their 2012 peak, while prices in Mount Isa dropped 35.6%.

Mining regions consistently demonstrate exceptional price volatility, with an average total range of 182.3% since 2005. Some regions like East Pilbara and Bridgetown experienced volatility exceeding 270%, while areas with more diversified economies, like Hunter Valley, NSW, showed greater price stability.

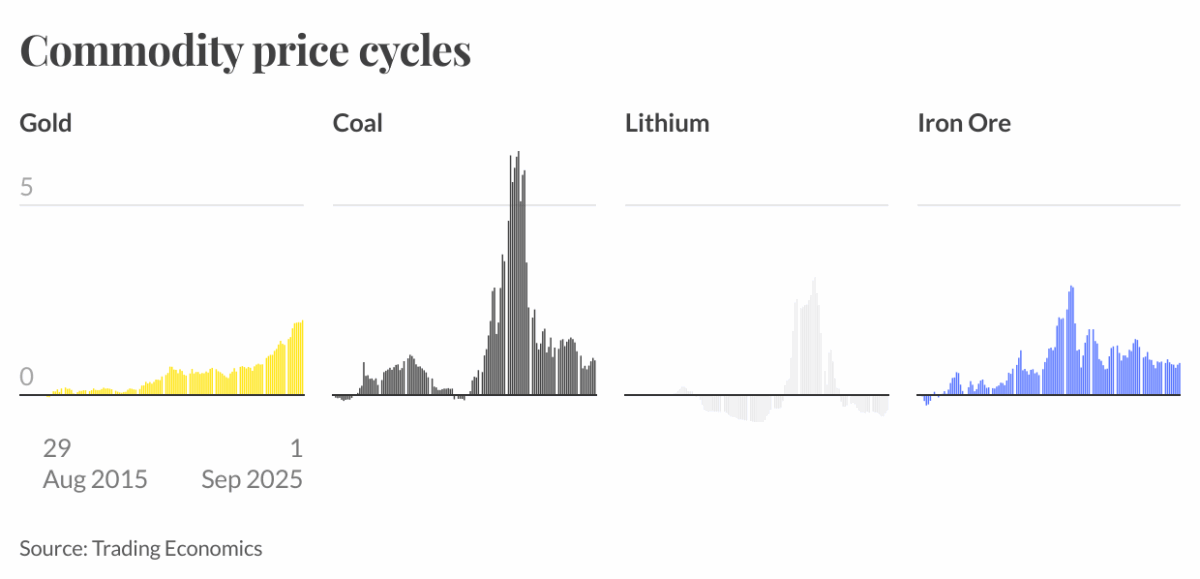

This extreme volatility reflects the concentrated economic base of mining communities, where single commodity cycles determine regional prosperity. During boom periods construction costs soar and supply shortages amplify price gains.

Regions with broader economic foundations — including tourism, agriculture and proximity to major cities — tend to experience more moderate price swings as alternative income sources provide stability during mining downturns.

Since 2017, mining region recovery has diverged sharply. In NSW’s Hunter Valley house prices now sit at record levels of $770,000, with the region’s proximity to Sydney, wine tourism industry and appeal as a lifestyle destination likely driving prices more than historic coal demand. Bowen Basin, Mount Isa and the Goldfields and Esperance regions in WA have all achieved new price records, with regions like Esperance also benefiting from coastal lifestyle migration and tourism growth alongside their traditional mining base.

Today’s mining regions sit at a peculiar point. Traditional commodity areas have largely recovered but remain sensitive to Chinese economic conditions and ongoing geopolitical tensions.

Regions proximal to iron ore operations, Australia’s largest export earner, remain scarred. The West Pilbara has recovered to 92.4% of its previous peak but remains $54,000 below its 2010 high and the East Pilbara sits 28% below its 2012 peak despite strong recovery momentum.

The global resource demand shift towards critical minerals and decarbonisation has created new cycles in lithium and green metals leading to flourishing market conditions in previously overlooked regions.

Bridgetown-Boyup Brook, one of Australia’s emerging lithium regions, experienced a modest 5.2% correction during the broader mining downturn. The region now shows record prices of $592,390 in face of an Australia wide lithium ramp up — a 270.3% increase from 2005 levels. Current lithium price volatility suggests these regions may experience tumultuous pricing cycles like their established counterparts.

The historical pattern suggests regions currently at record prices should prepare for eventual corrections, while those still recovering may prove more resilient having already worked through previous boom-bust cycles.

Understanding these cycles remains crucial for navigating the extreme volatility that defines resource-dependent housing markets.

The full 2025 Ray White Regional Report is expected later this year.