Yandal Resources acquires rights to key gold structure in WA

Yandal Resources (ASX:YRL) has acquired the rights to a key tenement to the immediate south of the Gordons project in WA.

The tenement, E27/701, was acquired following the initial phase one results of a 3D geological modelling and targeting exercise completed by independent consultant Ben McCormack from Outlier Geoscience.

The aim of the modelling and targeting is to determine the structural and stratigraphic controls on the mineralisation.

While the exercise is continuing, work so far has determined the delineation of the Gordon-Sirdar shear zone (GSSZ) and associated splays that extend through the Gordons project are coincident with the Star of Gordon prospect.

The GSSZ remains a high-priority target and further exploration will test the potential for plunging targets at depth.

Phase two of the modelling will consist of the collection of detailed geological information over the most prospective part of the GSSZ and the Star of Gordon prospect.

The aim of this will be to geochemically categorise lithologies as well as map the extent of alteration associated with gold mineralisation.

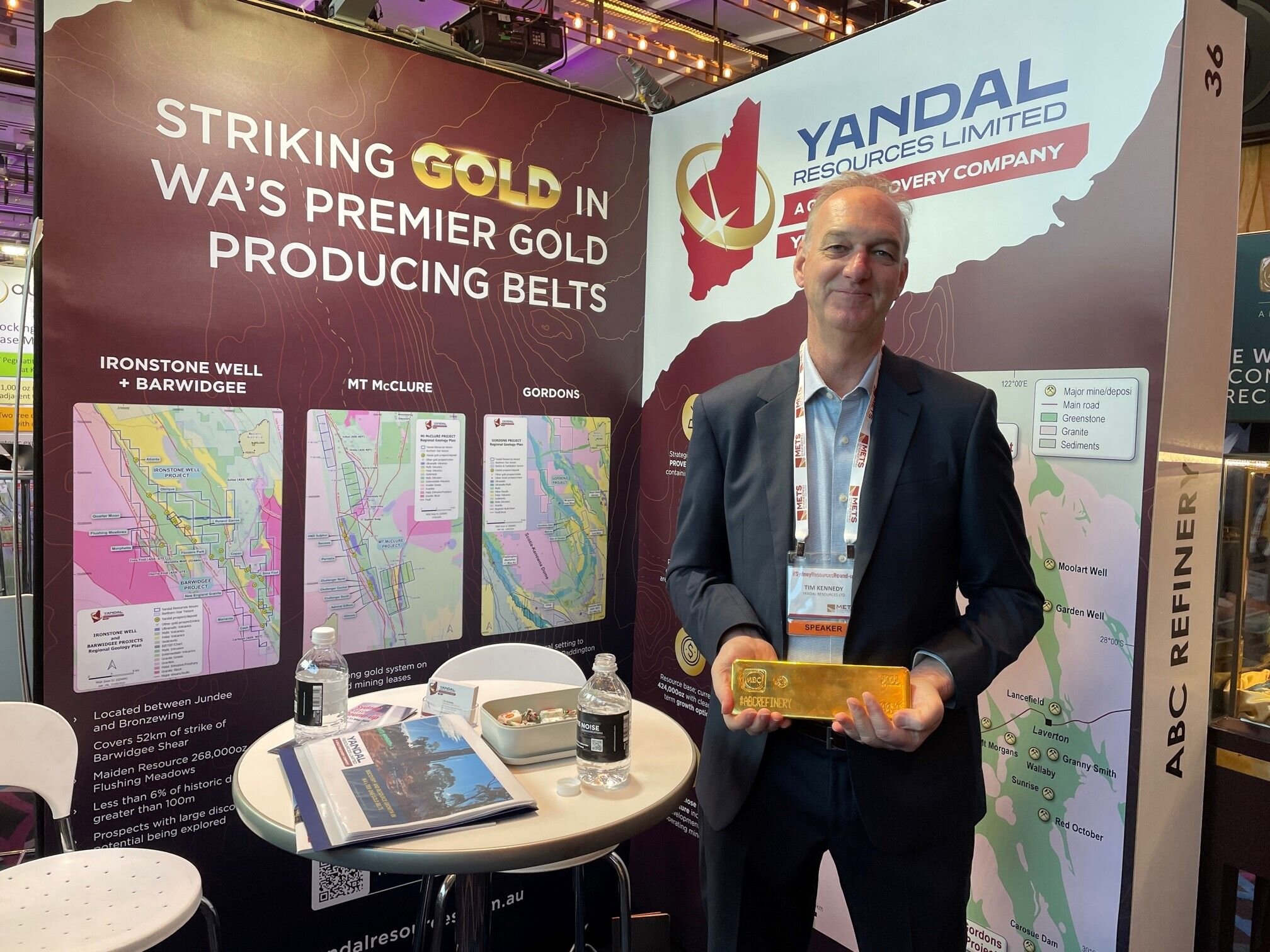

Managing director Tim Kennedy said the geological modelling allows Yandal to refocus its exploration efforts.

“The recently completed interpretation and targeting work undertaken by Ben McCormack has enabled us to refocus our efforts on those parts of the project with the highest potential for significant discovery,” he said.

“Importantly, it has highlighted an area immediately south of the project with all of the geological ingredients for a significant discovery that has yet to be explored in detail.”

Yandal has now entered a binding heads of agreement (HOA) to acquire 100% of E27/701 which has been subject to very little past exploration due to the periodic presence of salt lakes across the area.

Currently, the tenement is in the application phase by Moho Resources (ASX:MOH) and completion of the HOA is conditional upon granting of the tenement to Moho.

Yandal will pay $50k in cash to Moho with payment comprising an initial sum of $10k to enable Yandal to complete due diligence. The remaining $40k will be paid upon grant of the tenement.

Moho will retain 100% of the nickel and associated metals and a 1% net smelter return (NSR) on all gold production. Yandal will have a 1% NSR in all nickel and associated metals.

Both companies are working together to accelerate the licence grant to advance the commencement of exploration.