What we can’t grow or recycle, we must mine

The sentiment, coming from Andrew Forrest’s private mining company, Wyloo, is true to form for the billionaire — optimistic and future-focused despite the current uncertainty in nickel and rare earths markets.

The nickel industry is in the midst of a back-to-back surplus, as huge producers out of Indonesia come online with cheap nickel output, forcing many operations elsewhere to pause.

But potential market resurgences for the materials are expected as the metals key to enabling the energy transition. As the world continues to push for energy efficiency and to meet decarbonisation commitments, nickel is increasingly important.

“The world economy is currently facing changes to national policies, namely related to trade. This will probably contribute to a higher level of uncertainty regarding raw materials markets,” the International Nickel Study Group (INSG) said in an April 2025 statement.

“In Indonesia, delays in the issuance of mining permits (RKABs) resulted in ore tightness in the nickel market. The effect of the country’s new royalties on the mining sector is yet to be fully assessed. On the production side, it is anticipated that the output of different types of nickel product will continue to increase in 2025.

“In China, primary nickel output is also forecast to increase, driven by additional nickel cathode and nickel sulphate production. In contrast, NPI production is expected to continue to decline.

“Elsewhere, mainly due to profitability issues, a number of producing facilities in different countries have been suspended, reduced production or are considering the future possibility of one of these options.

But the INSG expects further growth in the stainless steel sector in 2025 while others hold out hope that nickel will begin to dominate battery chemistries.

“The expansion of nickel use in batteries has been slower than predicted, mostly due to the increased relative use of non-nickel containing batteries (mainly lithium iron phosphate) and higher demand for plug-in hybrid electric vehicles (EVs) at the expense of battery EVs. However, new ternary precursor cathode active material (pCAM) projects in different parts of the world will support a rise in nickel usage in the future,” the INSG said.

Rare earths too have been a major topic of interest, as the suite of elements make the technology we use in everyday life possible.

The US is heavily reliant on rare earth imports from China, which accounted for 70% of rare earth imports for the country between 2020 and 2023 according to Statista.

As the two countries go back and forth over tariffs and trade tensions tighten, the world is looking to secure alternative and diverse suppliers of the minerals.

Australia has the world’s sixth-largest reserves of rare earth minerals, and in 2019, ranked first globally with 24% of the world’s economic resources for nickel, positioning it well for market growth across the minerals.

Wyloo is moving forward deliberately across this portfolio.

The miner has recently acquired a controlling stake in the Yangibana rare earths project, now operated through a joint venture with Hastings Technology Metals.

With Yangibana set to enter production, Wyloo is positioned to play a central role in meeting surging demand for rare earths and strengthening Australia’s standing in the global critical minerals market

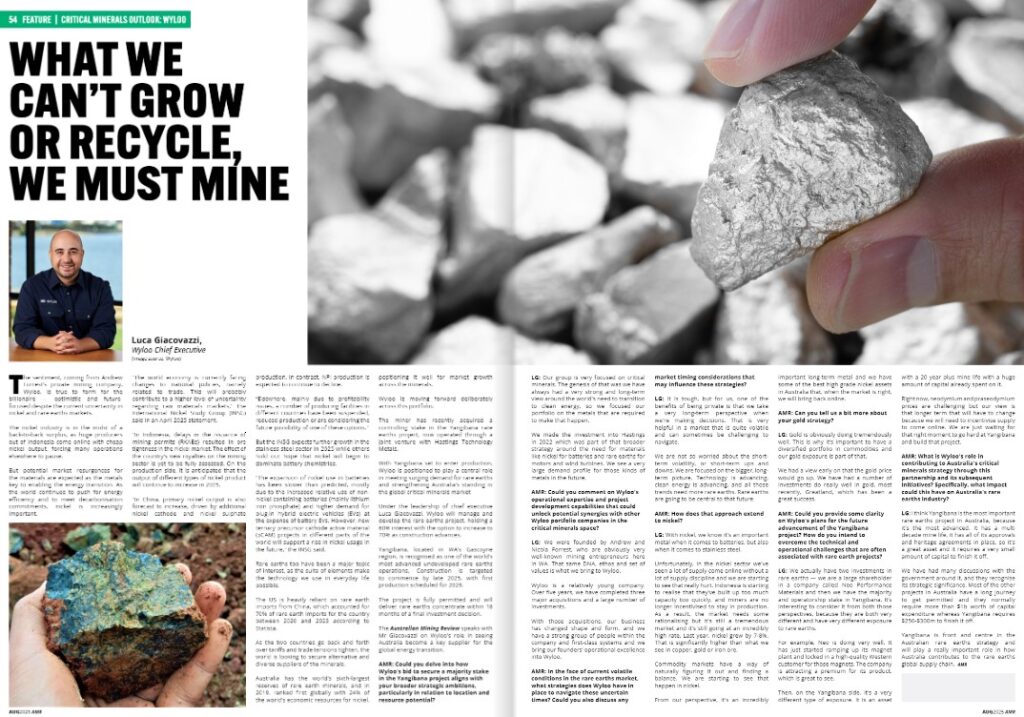

Under the leadership of chief executive Luca Giacovazzi, Wyloo will manage and develop the rare earths project, holding a 60% interest with the option to increase to 70% as construction advances.

Yangibana, located in WA’s Gascoyne region, is recognised as one of the world’s most advanced undeveloped rare earths operations. Construction is targeted to commence by late 2025, with first production scheduled for 2026.

The project is fully permitted and will deliver rare earths concentrate within 18 months of a final investment decision.

The Australian Mining Review speaks with Mr Giacovazzi on Wyloo’s role in seeing Australia become a key supplier for the global energy transition.

AMR: Could you delve into how Wyloo’s bid to secure a majority stake in the Yangibana project aligns with your broader strategic ambitions, particularly in relation to location and resource potential?

LG: Our group is very focused on critical minerals. The genesis of that was we have always had a very strong and long-term view around the world’s need to transition to clean energy, so we focused our portfolio on the metals that are required to make that happen.

We made the investment into Hastings in 2022 which was part of that broader strategy around the need for materials like nickel for batteries and rare earths for motors and wind turbines. We see a very large demand profile for those kinds of metals in the future.

AMR: Could you comment on Wyloo’s operational expertise and project development capabilities that could unlock potential synergies with other Wyloo portfolio companies in the critical minerals space?

LG: We were founded by Andrew and Nicola Forrest, who are obviously very well-known mining entrepreneurs here in WA. That same DNA, ethos and set of values is what we bring to Wyloo.

Wyloo is a relatively young company. Over five years, we have completed three major acquisitions and a large number of investments.

With those acquisitions, our business has changed shape and form, and we have a strong group of people within the company and first-class systems and we bring our founders’ operational excellence into Wyloo.

AMR: In the face of current volatile conditions in the rare earths market, what strategies does Wyloo have in place to navigate these uncertain times? Could you also discuss any market timing considerations that may influence these strategies?

LG: It is tough, but for us, one of the benefits of being private is that we take a very long-term perspective when we’re making decisions. That is very helpful in a market that is quite volatile and can sometimes be challenging to navigate.

We are not so worried about the short-term volatility, or short-term ups and downs. We are focused on the bigger, long-term picture. Technology is advancing, clean energy is advancing, and all those trends need more rare earths. Rare earths are going to be central to that future.

AMR: How does that approach extend to nickel?

LG: With nickel, we know it’s an important metal when it comes to batteries, but also when it comes to stainless steel.

Unfortunately, in the nickel sector we’ve seen a lot of supply come online without a lot of supply discipline and we are starting to see that really hurt. Indonesia is starting to realise that they’ve built up too much capacity too quickly, and miners are no longer incentivised to stay in production. As a result, the market needs some rationalising but it’s still a tremendous market and it’s still going at an incredibly high rate. Last year, nickel grew by 7-8%. That is significantly higher than what we see in copper, gold or iron ore.

Commodity markets have a way of naturally figuring it out and finding a balance. We are starting to see that happen in nickel.

From our perspective, it’s an incredibly important long-term metal and we have some of the best high grade nickel assets in Australia that, when the market is right, we will bring back online.

AMR: Can you tell us a bit more about your gold strategy?

LG: Gold is obviously doing tremendously well. This is why it’s important to have a diversified portfolio in commodities and our gold exposure is part of that.

We had a view early on that the gold price would go up. We have had a number of investments do really well in gold, most recently, Greatland, which has been a great success.

AMR: Could you provide some clarity on Wyloo’s plans for the future advancement of the Yangibana project? How do you intend to overcome the technical and operational challenges that are often associated with rare earth projects?

LG: We actually have two investments in rare earths — we are a large shareholder in a company called Neo Performance Materials and then we have the majority and operatorship stake in Yangibana. It’s interesting to consider it from both those perspectives, because they are both very different and have very different exposure to rare earths.

For example, Neo is doing very well. It has just started ramping up its magnet plant and locked in a high-quality Western customer for those magnets. The company is attracting a premium for its product, which is great to see.

Then, on the Yangibana side, it’s a very different type of exposure. It is an asset with a 20 year plus mine life with a huge amount of capital already spent on it.

Right now, neodymium and praseodymium prices are challenging but our view is that longer term that will have to change because we will need to incentivise supply to come online. We are just waiting for that right moment to go hard at Yangibana and build that project.

AMR: What is Wyloo’s role in contributing to Australia’s critical minerals strategy through this partnership and its subsequent initiatives? Specifically, what impact could this have on Australia’s rare earths industry?

LG: I think Yangibana is the most important rare earths project in Australia, because it’s the most advanced. It has a multi decade mine life, it has all of its approvals and heritage agreements in place, so it’s a great asset and it requires a very small amount of capital to finish it off.

We have had many discussions with the government around it, and they recognise its strategic significance. Most of the other projects in Australia have a long journey to get permitted and they normally require more than $1b worth of capital expenditure whereas Yangibana requires $250-$300m to finish it off.

Yangibana is front and centre in the Australian rare earths strategy and will play a really important role in how Australia contributes to the rare earths global supply chain.